A Practitioner’s Guide to Net Promoter Score

[Dear readers, this essay is about the practical aspects of measuring Net Promoter Score, an important metric that often correlates strongly with word-of-mouth virality. Sachin Rekhi, the author, has a blog and can be found on Twitter at @sachinrekhi. He’s was most recently Director of Product at Linkedin, leading the Sales Navigator product, and previously, an Entrepreneur-in-Residence at Trinity Ventures. Most importantly, Sachin married my sister Ada after meeting her in college at UPenn :) -Andrew]

Sachin Rekhi (ex-LinkedIn):

A Practitioner’s Guide to Net Promoter Score

Over the past year at LinkedIn I developed a strong appreciation for using Net Promoter Score (NPS) as a key performance indicator (KPI) to understand customer loyalty. In addition to the standard repertoire of acquisition, engagement, and monetization KPIs, NPS has become a great additional measure for understanding customer loyalty and ultimately an actionable metric for enhancing your product experience to deliver delight.

I wanted to share the best practices I’ve learned for implementing an NPS program within an organization to get the most out of this KPI for driving more delightful product experiences.

The Origin of NPS

Net Promoter Score (NPS) is a measure of your customer’s loyalty, devised by Fred Reichheld at Bain & Company in 2003. He introduced it in a seminal HBR article entitled The One Number You Need to Grow, which I highly recommend anyone serious about NPS to read in detail. Fred found NPS to be a strong alternative to long customer satisfaction surveys as it was such a simple single question to administer and was able to show correlation between NPS and long-term company growth.

How NPS is Calculated

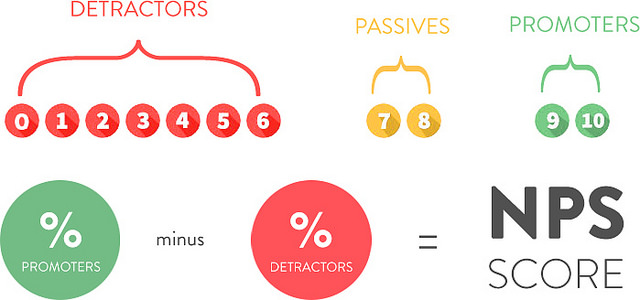

NPS is calculated by surveying your customers and asking them a very simple question: “How likely is it that you would recommend our company to a friend or colleague?” Based on their responses on a 0 – 10 scale, group your customers into Promoters (9-10 score), Passives (7-8 score), and Detractors (0-6 score). Then subtract the percentage of detractors from the percentage of promoters and you have your NPS score. The score ranges from -100 (all detractors) to +100 (all promoters). An NPS score that is greater than 0 is considered good and a score of +50 is excellent.

Additional NPS Questions

In addition to asking the likelihood to recommend, it’s essential to also ask the open-ended question: “Why did you give our company a rating of [customer’s score]?” This is critical because it’s what turns the score from simply a past performance measure to an actionable metric to improve future performance.

It’s also helpful to ask how likely they are to recommend your competitor products or alternatives, so you can establish a benchmark for how your NPS score compares to others in your industry as there are substantial differences in scores by product category. Keep in mind though that these results are biased since you are sampling your own customers for these benchmarks instead of a random cross-section of potential customers, including those who have chosen competitive solutions.

Many ask additional questions to understand additional drivers of the customer’s score. These are optional as while they add value in understanding the results, they add complexity which reduces the response rate, so you need to consider the trade-off of doing so.

Collection Methods

NPS scores for online products are typically collected by sending the survey via email to your customers or through an in-product prompt to answer the survey. To maximize response rates, it’s important to offer the survey across both your desktop & mobile experiences. While you could create such a collection tool in-house, I encourage folks to use one of the NPS survey solutions out there that support collection and analysis across a variety of channels and interfaces, such as one offered by my wife Ada’s employer SurveyMonkey.

One challenge with both email and in-product based survey methodologies is they tend to bias responses to more engaged customers as less engaged users are likely not coming back to the product nor answering your company’s emails as frequently. We’ll talk about potentially addressing this below.

Sample Selection

It’s important to survey a random representative sample of your customers each NPS survey. While that may sound easy, we found cases in which the responses weren’t in fact random and it became important to control for this in sampling or analysis. For example, we found strong correlation between engagement and NPS results. Therefore it was important to ensure your sample in fact reflects the engagement levels of your actual overall user base. Similarly, we found a correlation between customer tenure and NPS results as well, thus another key factor to ensure the customer tenure in the sample similarly matches that of your overall user base.

Survey Frequency

When thinking about how frequently to administer an NPS survey, there are several key considerations. The first is the size of your customer base. The smaller your customer base, the larger sample you need to survey each time or even wait longer for more responses to achieve a higher response rate, which limits how frequently you can administer future surveys. The second consideration is associated with your product development cycle. Product enhancements end up being one way to drive increases in scores and therefore the frequency of score changes depends on how quickly you are iterating on your product to drive such increases. NPS tends to be a lagging indicator so it takes time even after you’ve implemented changes to the customer’s experience for them to internalize the changes and then reflect such changes in their scores. On my team at LinkedIn we found it best to administer our NPS survey quarterly, which aligned with our quarterly product planning cycle. This enabled us to have the most recent scores before going into quarterly planning and enabled us to react to any meaningful observations from the survey in our upcoming roadmap.

Analysis Team

If your goal is to use NPS to drive more delightful product experiences, it’s important that you have all the key stakeholders involved in product development as part of the NPS analysis team. Without this, the NPS survey rarely get’s used as a meaningful part of the product development lifecycle. For us at LinkedIn, this meant including product managers, product marketing, market research, and business operations in the core NPS team. We also broadly share the findings with the entire R&D team each quarter. While it will certainly depend on your own development process, it’s critical to ensure the right stakeholders are involved right from the beginning.

Verbatim Analysis

The most actionable part of the NPS survey is the categorization of the open-ended verbatim comments from promoters & detractors. Each survey we would analyze the promoter comments and categorize each comment into primary promoter benefit categories as well as similarly categorize each detractor comment into primary detractor issue categories. The categories were initially deduced by reading every single comment and coming up with the large themes across them. We conducted this analysis every quarter so we could see quarter-over-quarter trends in the results. This categorization became the basis of how we came up with roadmap suggestions to address detractor pain points and improve their overall experience. While it can be daunting to read every comment, there is no substitute for the product team digging in and really listening directly to the voice of the customer and how they articulate their experience with your product.

Promoter Drivers

While oftentimes folks spend a lot of time looking at NPS detractors and how to address their concerns, we found it equally helpful to spend time on promoters and understanding what was different about their experiences to make them successful. We correlated specific behavior within the product to NPS results (logins, searches, profile views, and more) and found a strong correlation between certain product actions and a higher NPS. This can help deduce what your product’s “magic moment” is when your users are truly activated and likely to derive delight from your product. Then you can focus on product optimizations to get more of your customer base to this point. The best way to get to these correlations is simply to look at every major action in your product and see if there are any clear correlations with NPS scores. It’s easy to just graph and see if this is the case.

Methodology Sensitivities

We found NPS to be sensitive to methodology changes in the questions being asked. So it’s incredibly important to be as consistent in your methodology across surveys. Only with a fully consistent methodology can you consider results comparable across surveys. The ordering of the questions matters. The list of competitors that you include in the survey matters. The sampling approach matters. Change the methodology as infrequently as possible.

Seasonality

We found that there may be some seasonality at play in certain quarters that effect NPS results, correlating with engagement seasonality. We’ve heard that this is even truer for other businesses. So it may end up being more important to compare year-over-year changes as opposed to quarter-over-quarter changes to ensure the effects of seasonality are minimized. While this may not be possible, it’s at least important to realize how this could be effecting your scores.

Limitations of NPS

While NPS is an effective measure for understanding customer loyalty and developing concrete action plans to drive it up, it does have it’s limitations that are important to understand:

1. The infrequency of NPS results make it a poor operational metric for running your day-to-day business. Continue to leverage your existing acquisition, engagement, and monetization dashboards for tracking regular performance as well as for conducting A/B tests and other optimizations.

2. Margin of error with the NPS results depend on your sample size. It can often be prohibitive to get large enough of a sample to significantly reduce the margin of error. So it’s important to be aware of this and not sweat small changes in NPS results between surveys. More classic measures like engagement that don’t require sampling have a far lower margin of error.

3. NPS analysis is not a replacement for product strategy. It’s simply a tool for understanding how your customers are perceiving your execution against your product strategy as well as provides concrete optimizations you can make to better achieve your already defined strategy.

[This essay was first published here. Sachin Rekhi, the author, has a blog and can be found on Twitter at @sachinrekhi. He’s was most recently Director of Product at Linkedin, leading the Sales Navigator product, and previously, an Entrepreneur-in-Residence at Trinity Ventures. ]

PS. Get new updates/analysis on tech and startupsI write a high-quality, weekly newsletter covering what's happening in Silicon Valley, focused on startups, marketing, and mobile.

Views expressed in “content” (including posts, podcasts, videos) linked on this website or posted in social media and other platforms (collectively, “content distribution outlets”) are my own and are not the views of AH Capital Management, L.L.C. (“a16z”) or its respective affiliates. AH Capital Management is an investment adviser registered with the Securities and Exchange Commission. Registration as an investment adviser does not imply any special skill or training. The posts are not directed to any investors or potential investors, and do not constitute an offer to sell -- or a solicitation of an offer to buy -- any securities, and may not be used or relied upon in evaluating the merits of any investment.

The content should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Any charts provided here are for informational purposes only, and should not be relied upon when making any investment decision. Certain information contained in here has been obtained from third-party sources. While taken from sources believed to be reliable, I have not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. The content speaks only as of the date indicated.

Under no circumstances should any posts or other information provided on this website -- or on associated content distribution outlets -- be construed as an offer soliciting the purchase or sale of any security or interest in any pooled investment vehicle sponsored, discussed, or mentioned by a16z personnel. Nor should it be construed as an offer to provide investment advisory services; an offer to invest in an a16z-managed pooled investment vehicle will be made separately and only by means of the confidential offering documents of the specific pooled investment vehicles -- which should be read in their entirety, and only to those who, among other requirements, meet certain qualifications under federal securities laws. Such investors, defined as accredited investors and qualified purchasers, are generally deemed capable of evaluating the merits and risks of prospective investments and financial matters. There can be no assurances that a16z’s investment objectives will be achieved or investment strategies will be successful. Any investment in a vehicle managed by a16z involves a high degree of risk including the risk that the entire amount invested is lost. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by a16z is available at https://a16z.com/investments/. Excluded from this list are investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets. Past results of Andreessen Horowitz’s investments, pooled investment vehicles, or investment strategies are not necessarily indicative of future results. Please see https://a16z.com/disclosures for additional important information.