What 671 million push notifications say about how people spend their day

Push notifications are a cornerstone of every mobile app’s engagement and retention strategy, yet we know so little about them. Previously I’ve written about why 60% of users opt-out of push notifications and why some pushes are getting 40% CTRs.

Today, we’ll look at some push notification data from Leanplum, a mobile marketing automation tool, which breaks down 671 million pushes to uncover some interesting trends, particularly on time of day targeting for push notifications.

Average weekday push notification activity in North America

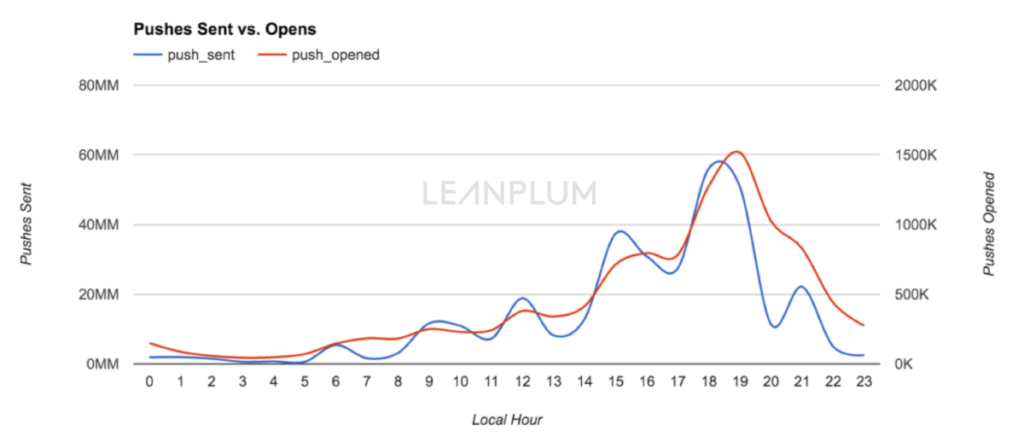

Let’s first look at when marketers are sending push notifications, by hour, and how users are interacting with these pushes. The graph below shows the metrics for push notification sends and opens for the average weekday in North America, on a sample of millions of notifications. The data is normalized by local hour, and represents the raw sends and opens for that given hour. The blue line shows the raw number of sends and uses the left axis. The red line shows the raw number of opens and uses the right axis.

You can see an interesting trend here- you can see pushes sent and opened trending upward throughout the day, with a small peak around noon, a slightly larger one around 3pm, and the largest in the evening. The post-evening trend is interesting – after 6pm, on a relative basis, Pushes Opened starts to trend higher, relative to previous hours, and Pushes Sent is lower. This indicates that while mobile apps are delivering a ton of pushes leading up to evening, it might be more effective to time them post-evening, when engagement seems high.

Either way, this curve is super interesting, and we should look at a typical day to understand the behavior patterns on how people spend their days.

Studies on the average day reinforce this trend

The American Time Use Survey visualization below shows why the aforementioned push notification graph makes sense. The video simulates the minute-by-minute average day of activities for 1,000 people, and what they do- some phone calls to sports to shopping to work.

View the visualization video here or click the image below:

In the morning hours from 7-9am, people are waking up and kicking off their morning rituals – eating, personal care, commuting to the office, and beginning to work. These consistent morning tasks that get you to the office and productive could justify why push engagement is low before 12pm. Around 3pm there is an interesting activity shift seen in the video that also correlates with a higher push send and open rate. This could be people taking a break to grab a coffee or get outside. Great time to take a look at your phone. By 6pm, most people have left work and transitioned to leisure activities.

It makes sense then why opens of push notifications are so high from 6-9pm. Work is done and people are likely to be on their phones, browsing apps and catching up on social media. The shift to leisure activities lasts for a few hours and by 10pm, most people have moved to personal care and sleep. The peak of push notification engagement follows a similar shape of post work leisure time.

Media consumption by medium

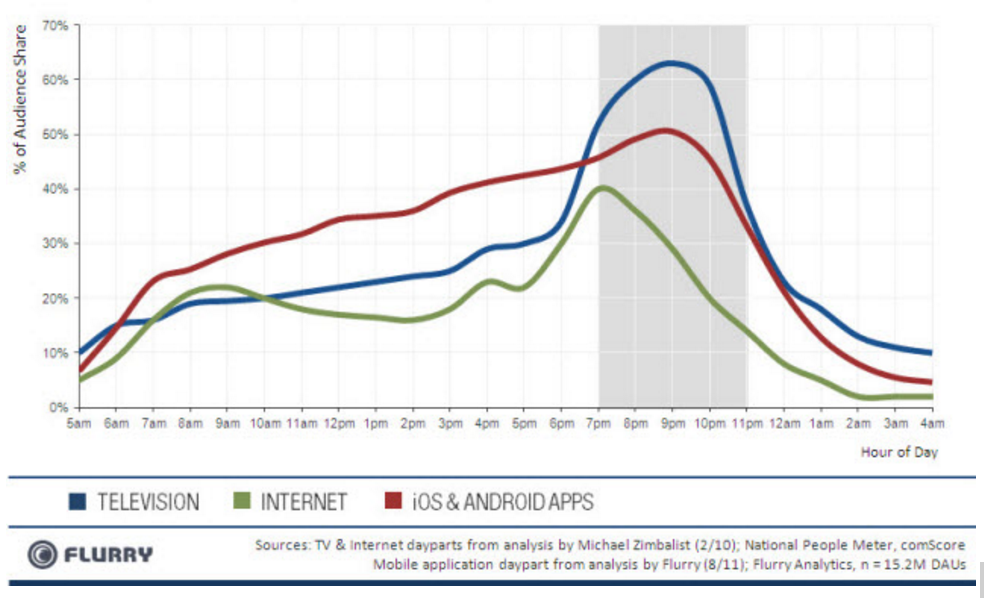

Ok, so we see that leisure activity correlates with higher opens of push notifications. What exactly are people doing during these leisure hours? The Flurry graph of daily media consumption by channel shows some interesting trends:

Couple obvious notes:

- Internet usage has two main peaks: one at 8am and a larger one at 7pm.

- iOS and Android app usage kicks up in the morning around 7am, gradually builds throughout the day before falling off its peak at 9pm.

- TV is clearly an after work deal, with a huge peak between 7 and 11pm.

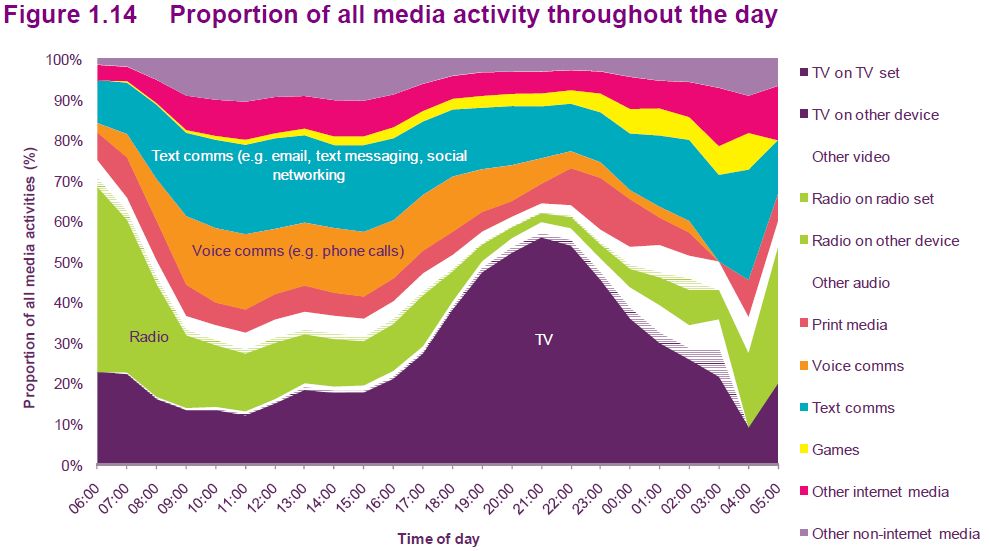

You can match this up to this similar chart analyzing media consumption in the UK, via Ofcom:

With both charts, you can see that, TV appears to be a significant portion of the leisure hours, especially after work. Voice communication tends to be constrained to the day, while online comms (SMS/email) happens throughout the day.

Push notification engagement versus media consumption

To tie this daily pattern to the Leanplum push notification engagement data, we can speculate why people are engaging with pushes in the evening. I bet we’re seeing the effect of mobile as the second screen, where people are engaging with push notifications while casually watching TV. They likely have their phones in their pocket or nearby, and can easily catch up on apps.

Thanks to David Grotting and Leanplum for their help on this essay.

PS. Get new updates/analysis on tech and startups

I write a high-quality, weekly newsletter covering what's happening in Silicon Valley, focused on startups, marketing, and mobile.

Views expressed in “content” (including posts, podcasts, videos) linked on this website or posted in social media and other platforms (collectively, “content distribution outlets”) are my own and are not the views of AH Capital Management, L.L.C. (“a16z”) or its respective affiliates. AH Capital Management is an investment adviser registered with the Securities and Exchange Commission. Registration as an investment adviser does not imply any special skill or training. The posts are not directed to any investors or potential investors, and do not constitute an offer to sell -- or a solicitation of an offer to buy -- any securities, and may not be used or relied upon in evaluating the merits of any investment.

The content should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Any charts provided here are for informational purposes only, and should not be relied upon when making any investment decision. Certain information contained in here has been obtained from third-party sources. While taken from sources believed to be reliable, I have not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. The content speaks only as of the date indicated.

Under no circumstances should any posts or other information provided on this website -- or on associated content distribution outlets -- be construed as an offer soliciting the purchase or sale of any security or interest in any pooled investment vehicle sponsored, discussed, or mentioned by a16z personnel. Nor should it be construed as an offer to provide investment advisory services; an offer to invest in an a16z-managed pooled investment vehicle will be made separately and only by means of the confidential offering documents of the specific pooled investment vehicles -- which should be read in their entirety, and only to those who, among other requirements, meet certain qualifications under federal securities laws. Such investors, defined as accredited investors and qualified purchasers, are generally deemed capable of evaluating the merits and risks of prospective investments and financial matters. There can be no assurances that a16z’s investment objectives will be achieved or investment strategies will be successful. Any investment in a vehicle managed by a16z involves a high degree of risk including the risk that the entire amount invested is lost. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by a16z is available at https://a16z.com/investments/. Excluded from this list are investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets. Past results of Andreessen Horowitz’s investments, pooled investment vehicles, or investment strategies are not necessarily indicative of future results. Please see https://a16z.com/disclosures for additional important information.