Case studies from “Why you can’t find a technical co-founder”

This is a followup guest post by Elizabeth Yin on her popular essay, Why you can’t find a technical co-founder. Liz is the CEO and a co-founder of LaunchBit, an ad network for email newsletters. Previously, she worked at startups and Google, and went to MIT for her MBA, and Stanford before that.

Elizabeth Yin:

Why you can’t find a technical co-founder (part II)

I received a lot of emails about my last post on Andrew’s blog: Why you can’t find a technical co-founder, which discussed:

-

Deal-breakers for non-technical entrepreneurs who are looking for technical co-founders (for example: location isn’t a deal breaker but idea validation is)

-

How to get traction on a product idea without a product

-

3 examples of startups (AngelList, Yipit, and Beat the GMAT) who have become successful today but started without full-fledged products

So, I wanted to dive into this topic more.

Building a minimum viable product with a static website

It can be all too easy to want to build out a full-fledged minimum viable product in code. But, as an entrepreneur, you only have so much runway. One of the best ways to cut down on the time required to get to product/market fit is to skip the coding process entirely. It’s more time-consuming to program in one direction only to realize that you need to build something in a completely different direction. Not to mention, morale takes a hit when you have to scrap all your work.

So, one of the best ways to speed up time-to-market is to build a minimum viable product with a static website. Disclaimer: this isn’t possible for every product, but a lot of web business ideas can be built initially with simple static websites.

Here are two case studies of companies that first used simple websites to test their respective business ideas before building out full-fledged dynamic sites. It was these static websites that helped them find product-market fit very quickly, which enabled them to scale sooner.

Fandeavor

Fandeavor is a company that offers game-day experiences. Founders Tom Ellingson and Dean Curtis previously worked at Zappos, a company that would often sponsor sporting events. Tom and a handful of Zappos employees would often get red carpet treatment at these sporting events, but these special experiences were limited only to high-end sponsors. “But what if general consumers could purchase the same awesome sporting experiences too?” they wondered. So before they left their full-time jobs, they decided to test whether this idea had any legs.

Tom called up a contact at the University of Nevada Las Vegas (UNLV) who ran sports tournaments. Tom convinced him that the Fandeavor team could help him sell special sporting experiences around the upcoming tournaments. These gameday packages would include things like signed basketballs, box suites, special sports gear, and even the opportunity to present the game ball at mid court. In parallel, Dean set up a basic website that would provide information about these gameday experiences.

Fandeavor’s initial website

Through a cross-promotional partnership with UNLV, who promoted these experiences through their Facebook fanpage, these first experiences quickly sold-out. It was from testing these first experiences that the Fandeavor team realized that doing cross-promotions with other organizations to promote their gameday packages helped them build their audience and also made their sales successful.

The duo continued testing their business idea by offering more experiences on their website. They even created sections of their site that were empty but helped track demand of what teams and sports people were most interested in. Just simply by tracking clicks on their relatively simple site, they could figure out what types of experiences to offer next.

Tom and Dean left their day jobs at Zappos to work on Fandeavor full-time. But soon, they realized that the kind of experiences people were interested in were not necessarily box suites. A lot of consumers wanted even simpler things — help with travel, hotels, and other logistics in building a great trip experience around tournaments and games. These were experiences that the team could build with virtually no special business development deals. So, they started curating these experiences themselves manually. Eventually, they were able to develop a process around doing this efficiently.

From doing quick tests using a simple website, Fandeavor was able to figure out the mechanics behind how to get their supply (the right curatable gameday experiences) and the demand (promoting through cross-promotional partnerships).

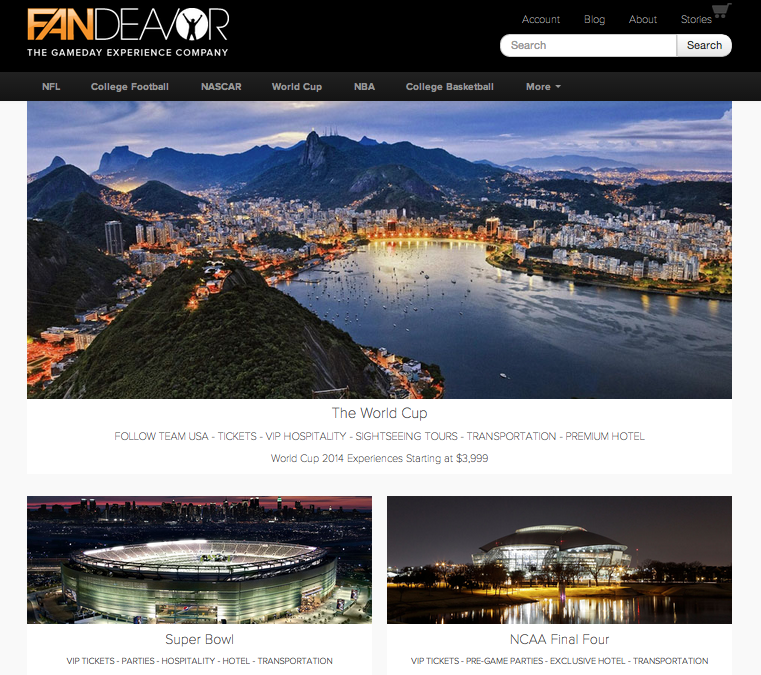

Fandeavor’s website today

Once they established the processes for scaling both sides up, they were able to later build a much more sophisticated backend to curate all their experiences and build their team to repeat these processes. Today, Fandeavor has raised $525k and is growing 50% month over month.

Moveline

Moveline is a company that aggregates moving quotes from moving companies. Founders Kelly Eidson and Fred Cook realized that the moving process was difficult for people for a whole variety of reasons and wanted to help make this process better.

Fred and Kelly collected leads on a simple website to start working with qualified consumers. And soon, they started going into homes of people who were moving to talk with them about moving issues.

Moveline’s initial website

Kelly and Fred quickly learned that it was a headache for people to document every little thing they had to move and then submit all those items to different moving companies to get quotes. Kelly and Fred realized that the crux to making the moving process better was to develop a better way of itemizing objects.

At first, the Moveline team was not really sure how to do this better. They initially went into people’s homes and manually categorized items into spreadsheets. They repeated this with dozens of people who were moving. The breakthrough in building a process around this came when someone in a different city contacted them requesting their itemization-help. Not able to physically go to that person’s home, Fred and Kelly asked to do the itemization over Facetime. It turned out they were able to accurately and quickly itemize over the video conferencing software, which later became a part of Moveline’s core product. It turned out that using video conferencing software gave them an edge — they could itemize just about any move from anywhere without requiring local on-the-ground teams.

It was from these initial conversations with dozens of consumers that Moveline was able to tease out a very specific problem to solve in moving. And, once they were able to manually figure out how to use technology to solve this problem, they were ready for scale. It was because they used a simple website that fed them leads, but still required the team to “be the product,” they were able to really understand and solve this particular problem in moving.

Moveline’s website today

Only once they had a clear idea of what needed to be built into the product, Fred started hiring a team of engineers and product people to build the first version of Moveline’s software. Today, Moveline is an 18 person company, has raised $3 million in funding, and since launching nationally in March has added over 200 moving companies to its network. They now serve customers in over 100 cities in the U.S. and internationally.

Both Moveline and Fandeavor primarily used static websites to collect leads and kickoff interactions with potential customers. Although static sites don’t seem very sophisticated, through the use of simple input fields and forms, you can collect information to vet potential leads, and you can use them to collect customer insights. Static websites are a great way to quickly test your product and get to product/market fit.

For more examples of companies who built minimum viable products without coding, see these awesome posts written by Ryan Hoover and Vin Vacanti:

P.S. If you want to learn how to build your first web prototype without coding, attend this workshop I’m hosting on Building a Mobile-friendly Websites Without Code on October 3. Get 25% off with this discount code: “andrew-hustler”.

PS. Get new updates/analysis on tech and startups

I write a high-quality, weekly newsletter covering what's happening in Silicon Valley, focused on startups, marketing, and mobile.

Views expressed in “content” (including posts, podcasts, videos) linked on this website or posted in social media and other platforms (collectively, “content distribution outlets”) are my own and are not the views of AH Capital Management, L.L.C. (“a16z”) or its respective affiliates. AH Capital Management is an investment adviser registered with the Securities and Exchange Commission. Registration as an investment adviser does not imply any special skill or training. The posts are not directed to any investors or potential investors, and do not constitute an offer to sell -- or a solicitation of an offer to buy -- any securities, and may not be used or relied upon in evaluating the merits of any investment.

The content should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Any charts provided here are for informational purposes only, and should not be relied upon when making any investment decision. Certain information contained in here has been obtained from third-party sources. While taken from sources believed to be reliable, I have not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. The content speaks only as of the date indicated.

Under no circumstances should any posts or other information provided on this website -- or on associated content distribution outlets -- be construed as an offer soliciting the purchase or sale of any security or interest in any pooled investment vehicle sponsored, discussed, or mentioned by a16z personnel. Nor should it be construed as an offer to provide investment advisory services; an offer to invest in an a16z-managed pooled investment vehicle will be made separately and only by means of the confidential offering documents of the specific pooled investment vehicles -- which should be read in their entirety, and only to those who, among other requirements, meet certain qualifications under federal securities laws. Such investors, defined as accredited investors and qualified purchasers, are generally deemed capable of evaluating the merits and risks of prospective investments and financial matters. There can be no assurances that a16z’s investment objectives will be achieved or investment strategies will be successful. Any investment in a vehicle managed by a16z involves a high degree of risk including the risk that the entire amount invested is lost. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by a16z is available at https://a16z.com/investments/. Excluded from this list are investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets. Past results of Andreessen Horowitz’s investments, pooled investment vehicles, or investment strategies are not necessarily indicative of future results. Please see https://a16z.com/disclosures for additional important information.