How Google and Zynga set & achieve meaningful OKRs (Guest Post)

[The topic of setting goals, especially quantitative ones, is a really important topic for any team and any startup. A common format has been the OKR, or “Objectives and Key results” which is in use at Google, Zynga, and many other companies. It consists of setting an objective, and also a series of measurable results aligned with that objective. My good friend Kenton Kivestu, (now Flurry but previously Zynga and Google) has experienced this framework first hand and had a lot of insightful stuff to say about it. You can follow Kenton on Twitter and read his blog here. -Andrew]

Kenton Kivestu, Flurry:

How to set & achieve meaningful OKRs

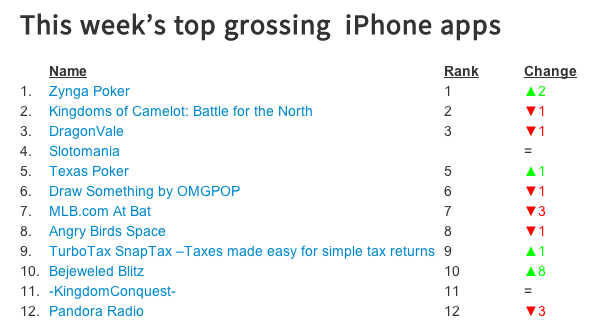

In 2011, when I joined Zynga to work on the mobile poker franchise, we were getting trounced by a competitor named Texas Poker. Their UX was better. They were smoking us on appstore top grossing rankings. And they had 5x the features (not to mention a “premium” pro version of the game they’d just launched). For a company who unequivocally dominated the poker space on FB, our position in the mobile poker market was borderline comical.

The team set an OKR to take the throne: become the #1 top grossing iOS poker game. And then something incredible happened, we did (~6 months later). In my career, I’ve seen many an OKR go haywire (both at Google and Zynga) so this post is my attempt to distill & isolate the common traits I’ve seen in good implementations of an OKR.

First, what is an OKR and why bother?

Google has used OKRs since 1999 at the urging of KPCB partner John Doerr and Rick Klau (former Googler, now Google Ventures partner) has a good post on what is an OKR is (and it’s history). And you can read up on them at Quora too. But the TL;DR is an OKR is a stated goal, known to the whole company and has a pre-defined rubric to measure your success in achieving it.

Whether your at a start-up or big co, the only thing in endless supply is constraints. Time, developer resources, energy and the list goes on. And in a resource constrained world, the best plan of attack is to marshall resources and focus efforts on the best leverage point.

Now the question is, how do you set good OKRs? Like all things, there are many ways to successfully skin a cat but the 3 most common traits I’ve seen in teams that have set and achieved awesome results with OKRs are these:

Measurable

Contrary to popular belief, this doesn’t mean the the OKR needs to be explicitly quantitative (eg drive X% increase in sign-ups or Y% year over year growth in recurring revenues), although it’s fine if that is the case. But it definitely needs to be measurable in the sense that the team can unequivocally evaluate their progress at the end of the OKR period.

For us, the iOS app store Top Grossing rankings were our measuring stick (for better or worse). There was no fudging the numbers and it was dead simple to measure, we were either ahead or behind.

Focused

OKRs are like money. Mo’ money, mo’ problems. The surest way to negate any positive impact from a good OKR is to set 10 good OKRs. It can seem alluring at first – “we’ll accomplish so many things this quarter/year!” – but it will backfire. There is little doubt that 10 good OKRs is worse than nothing. Your team will be torn between competing priorities – should John the engineer work on X or Y this sprint? One will get us closer to OKR A and the other toward OKR B. Inevitably this leads to prioritizing OKRs – this might work if you have 1 or 2 but anymore than that is going to be a recipe for a wasted quarter.

For us, we had 1. If a feature/chunk of work didn’t directly contribute to us climbing the iOS top grossing rankings, it was de-prioritized. As a result, we got a late start on expanding to other platforms (Android tablets, Kindle Fires). That was painful but the focus brought the right end result, since the iOS Top Grossing “pot o’ gold” was orders of magnitude more rewarding than early adoption of Fire or And tablets.

Worth doing

Again, this seems obvious but is worth stating. A good sanity test is ask yourself, “If the company were a person, would it put the successful completion of this OKR on its resume?” If the answer is no, boot it. All too often well-intentioned but “empty” OKRs end up dictating resource allocation. These culprit OKRs typically rise out of a discussion around some product tactics (eg let’s reduce friction in the sign-up flow by X%).

Ok, but OKRs stunt our creativity

An oft argued counterpoint is that OKRs will stunt creativity and the team’s ability to tinker and meander into some great discovery. Defenders of this theory highlight examples of accidental discoveries leading to huge innovations – but this is missing the point. OKRs don’t preclude accidental discoveries, they simply make sure that in absence of a brilliant accident the team is on track to do something else meaningful.

If you’re finding your team sets quarterly OKRs only to trash them each quarter given a brilliant mid-quarter discovery, you’re either:

- a 2-sigma team that repeatedly launches industry leading core features every quarter despite not initially planning them

- setting OKRs not “worth doing” as evidenced by repeated willingness to ditch them

- unfocused and need more operational discipline

In conclusion

OKRs are not a panacea. And they can lead a team astray if they don’t keep them focused, measurable and meaningful. But the flip side is that a well-set OKR can generate a 10x result. OKRs can drive focus and relentless execution, and in turn, those drive incredible results.

I write a high-quality, weekly newsletter covering what's happening in Silicon Valley, focused on startups, marketing, and mobile.

Views expressed in “content” (including posts, podcasts, videos) linked on this website or posted in social media and other platforms (collectively, “content distribution outlets”) are my own and are not the views of AH Capital Management, L.L.C. (“a16z”) or its respective affiliates. AH Capital Management is an investment adviser registered with the Securities and Exchange Commission. Registration as an investment adviser does not imply any special skill or training. The posts are not directed to any investors or potential investors, and do not constitute an offer to sell -- or a solicitation of an offer to buy -- any securities, and may not be used or relied upon in evaluating the merits of any investment.

The content should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Any charts provided here are for informational purposes only, and should not be relied upon when making any investment decision. Certain information contained in here has been obtained from third-party sources. While taken from sources believed to be reliable, I have not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. The content speaks only as of the date indicated.

Under no circumstances should any posts or other information provided on this website -- or on associated content distribution outlets -- be construed as an offer soliciting the purchase or sale of any security or interest in any pooled investment vehicle sponsored, discussed, or mentioned by a16z personnel. Nor should it be construed as an offer to provide investment advisory services; an offer to invest in an a16z-managed pooled investment vehicle will be made separately and only by means of the confidential offering documents of the specific pooled investment vehicles -- which should be read in their entirety, and only to those who, among other requirements, meet certain qualifications under federal securities laws. Such investors, defined as accredited investors and qualified purchasers, are generally deemed capable of evaluating the merits and risks of prospective investments and financial matters. There can be no assurances that a16z’s investment objectives will be achieved or investment strategies will be successful. Any investment in a vehicle managed by a16z involves a high degree of risk including the risk that the entire amount invested is lost. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by a16z is available at https://a16z.com/investments/. Excluded from this list are investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets. Past results of Andreessen Horowitz’s investments, pooled investment vehicles, or investment strategies are not necessarily indicative of future results. Please see https://a16z.com/disclosures for additional important information.