What’s next in growth?

[I recently gave the keynote at the largest startup conference in Australia, StartCon. Many awesome growth folks were there, including Elena Verna at SurveyMonkey, Nate Moch at Zillow, Sean Ellis at GrowthHackers, etc. My talk is below, with links to my talk, preso PDF, etc at the bottom. If you want to see all the conference talks, they’re here. Thanks! -A]

In tech, we’re always thinking about the future.

This is why it’s no surprise that one of the most common questions I get is: What’s next in growth? As practitioners in growth, marketing, entrepreneurship, and tech, we’re looking for the edge that’ll give our products a chance to succeed in an extremely competitive and dynamic environment.

The answer to this isn’t simple – there isn’t an obvious closed form solution, so I won’t try to give a “tips and tricks” kind of answer. Instead, let’s talk about how to systematically answer this in a way that’ll be relevant today as well as 10 years from now.

First, we have to zoom out.

Technology, products, growth, and marketing don’t exist in a vacuum. There’ve been many products, and lots of smart folks thinking about this problem for a long time. If we look back at what’s come before us, we can try connecting the dots to see if we can spot any patterns.

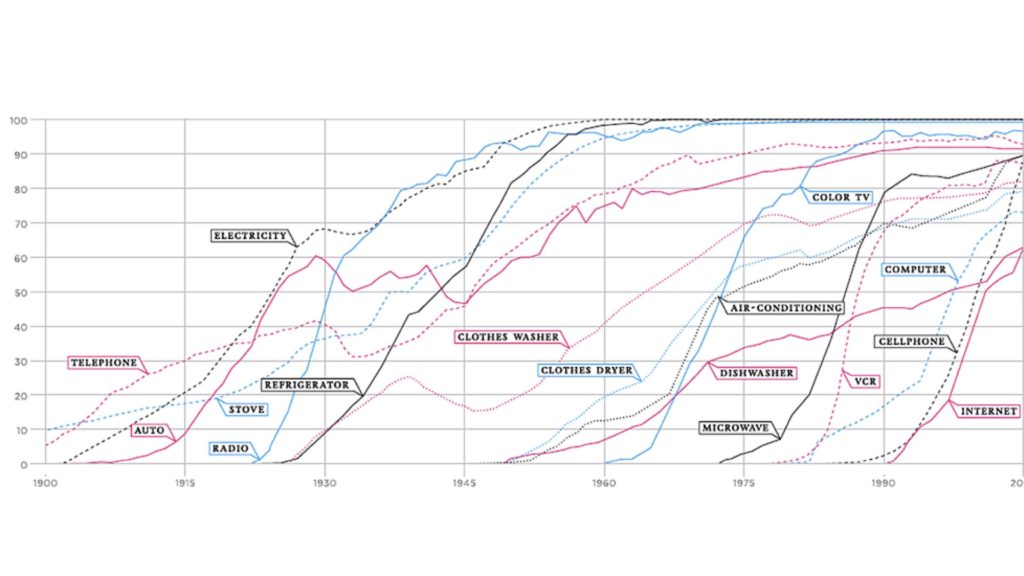

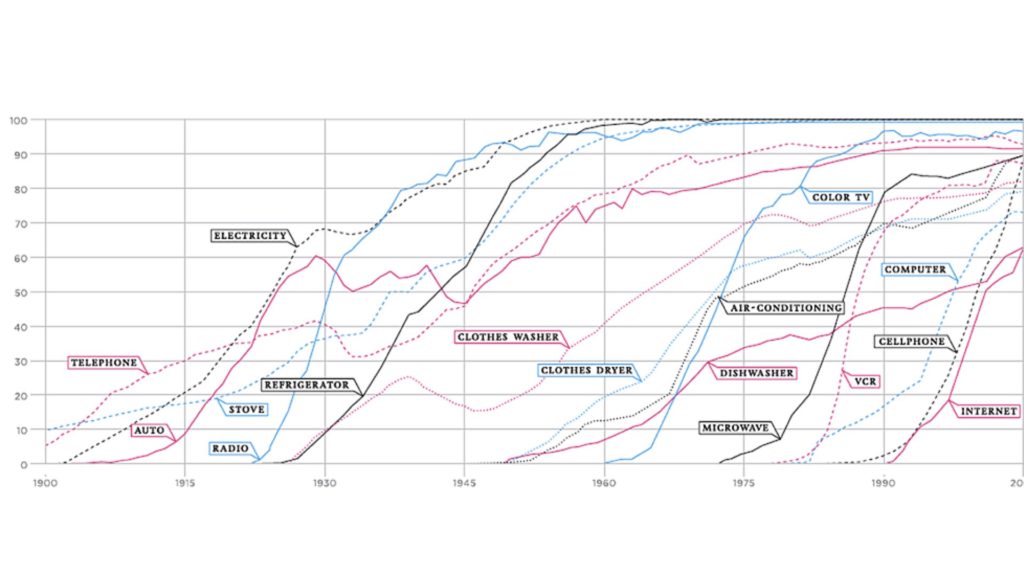

The first thing we spot when we zoom out is that the pace of innovation has been speeding up:

Here’s a graph of various technologies and how fast they’ve been adopted over the last hundred years. It used to be that products like the telephone or electricity took on order of 50 years to go from 0% of the US population to 90%. In the last recent cycles, things have been going much faster – the internet, cellphones, and the computer have all hit massive penetration within just 10 years. Amazing.

This also means that strategies for growing your products are becoming even more competitive, dynamic, and tricky.

Today, we’re going to look at three common techniques for growth:

- Getting customers to refer friends

- Spreading viral content

- Bootstrapping marketplaces

Let’s look at what these problems looked like 100+ years ago, and how we’re thinking about them now. I think we can learn a lot by connecting the dots.

We’ll start with customer referrals:

OK- classic move. How do we get customers to refer their friends? Some of the biggest and most successful products grow this way.

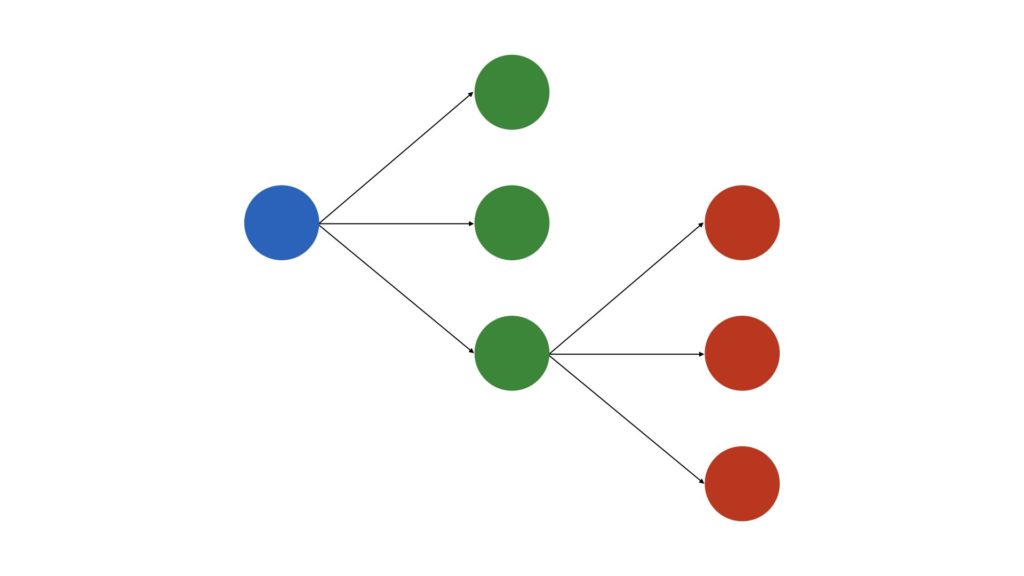

You might think of it conceptually like this:

From a fundamental path, it’s all about building a tree – getting one person to refer many friends, of which a small percentage will go on to refer the next generation of friends, and so on.

The idea here is that if we can make this happen in a chain, then we get a viral loop, which grows and grows awareness for your products.

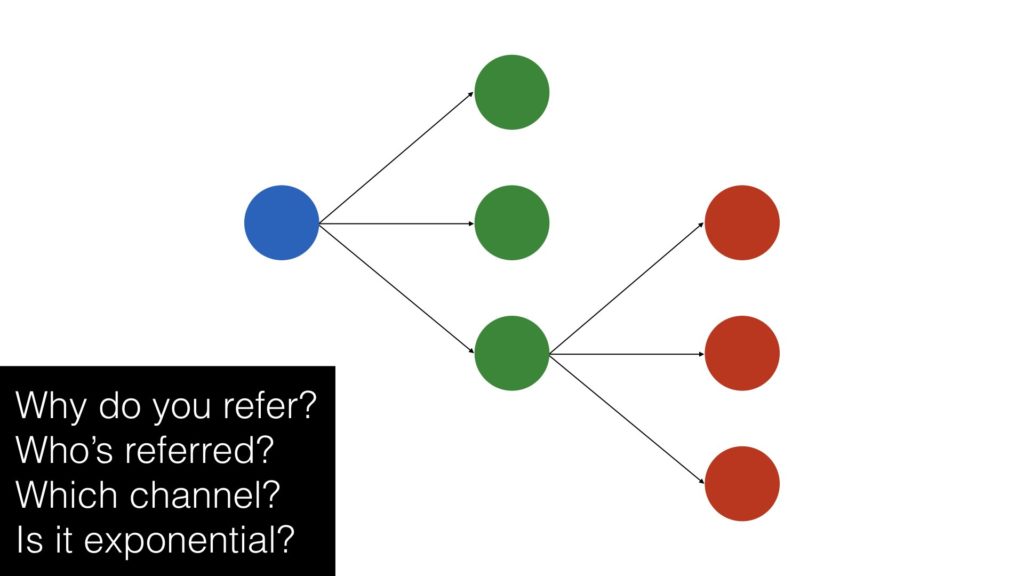

No matter what kind of marketplace, the questions you have to answer – in any configuration here – are quite simple.

We need to figure out why you refer people. Is it monetary? Is it because the product gains in utility as more people join? Is it because you want to galvanize a collective response – like voting on a poll?

Who do you invite? Is a small network of close friends and family? Or is it a wide group, like a YouTube video where you want millions of views from people you may not even know?

What channel do the invites happen in? Is it real life word of mouth? Or do you ask people to import their email addressbooks? Or is it through a new platform like messaging/SMS on mobile?

And finally, is this referral process successful – exponential?

We have to answer these questions for any new referral system in a digital product, but what’s surprising is, folks had to answer this question in the past as well, for anything they want to spread between friends.

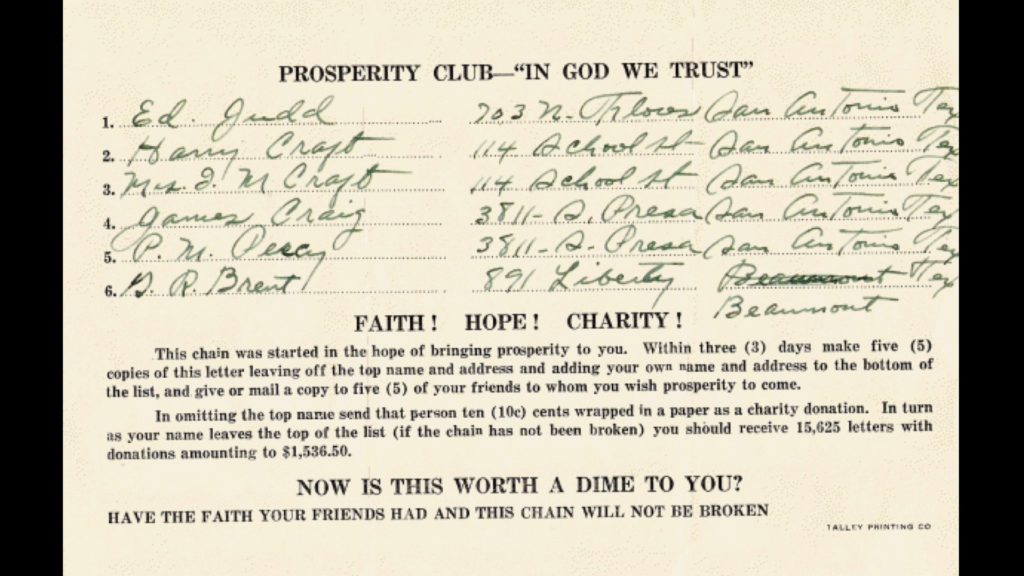

Here’s a simple example: Chain letters.

Here’s an example of one of the oldest chain letters. It promised something pretty simple – if you send this to a bunch of your friends, and include some money to the folks on the list, while simultaneously adding yourself to the beneficiaries list, then you’ll get rich.

The call to action is even super specific: Within 3 days, make 5 copies, and send to 5 of your friends. Doesn’t that remind you a little bit of Facebook’s “7 friends in 10 days” internal guidance, in fact? :)

The point here is that they had to answer all the questions. You invite people to make money. The channel is email. You invite friends you want to be prosperous.

Ultimately, how different is this kind of call to action to the referral programs we see in tech products?

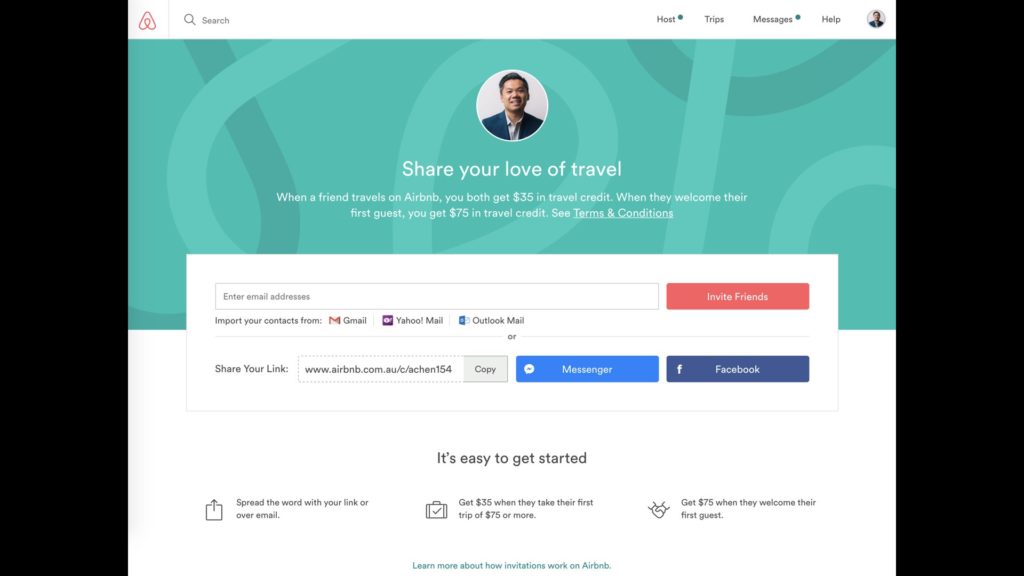

For Airbnb, you invite your friends so that both of you can get $35 in travel credit.

Sure, there’s major advancements. First, there’s an awesome product behind this loop, not just an unsustainable chain letter :)

Also, there’s Messenger and Facebook integration. You can invite your Gmail, Yahoo, and Outlook contacts so they tap into a massive social graph via the various platforms. Airbnb also uses a personalized link so that they can track attribution and personalize the landing pages and flows for the invitees.

Much more sophisticated in some ways, but the basics are similar to what existed 100 years ago.

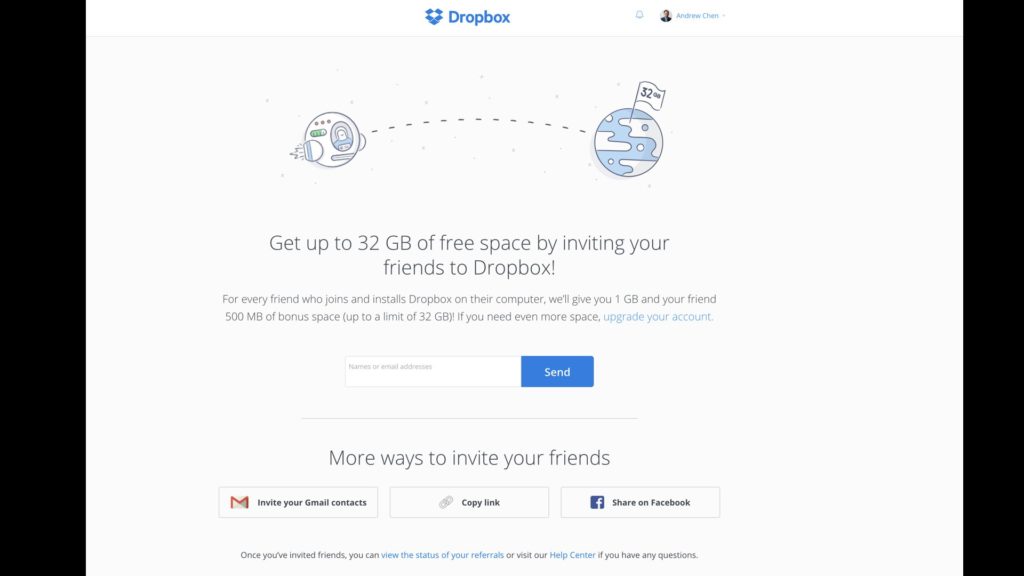

Same with Dropbox, where you can give and get space. Same with many other referral programs.

The behaviors that cause people to do this are the same as what existed in the past – there’s a personal incentive for the sender, but also an incentive for the recipient. There’s a clear call to action, and a channel these messages travel upon. We can do so much more these days by integrating into platforms, and by tracking, and our sophistication in metrics like viral factor and cohort analysis, but the same general trust is there.

Next, let’s talk about spreading viral content:

Imagine this: The world gets a disruptive new technology, democratizing publishing. All of a sudden, it’s much easier for people to publish whatever content they want. The cost to publish media goes way down. A big boom proliferates, with many new kinds of media being created. Some of it is fancy, some of it is drivel. This drives societal change across many dimensions.

Is this the social media revolution in tech from the last 10 years?

No, this is the penny press revolution from 150 years ago.

Turns out, 150 years ago, we dealt with many of the same forces that affect us today in social media.

The newspaper industry went from hand-crafted to steam-powered printing. The daily press became accessible to everyone, as you could buy papers for 1 cent rather than 6 cents, spawning a brand new industry including papers like The New York Daily Times, which eventually became The New York Times.

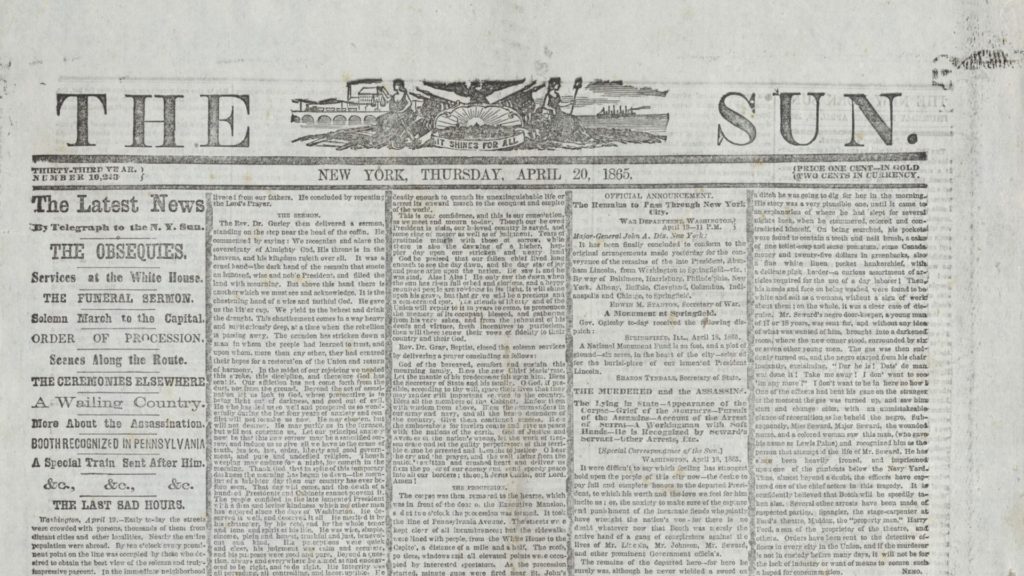

But we’re not going to talk about the NYT, we’re going to talk about one of their cross-town rivals, The Sun of New York.

Let’s give a flavor of how they were defining news at the time:

This is great, right? News for everyone. Much cheaper. Spread all that information – it wants to be free!

Sounds amazing in theory, but we also quickly faced a problem: Fake news.

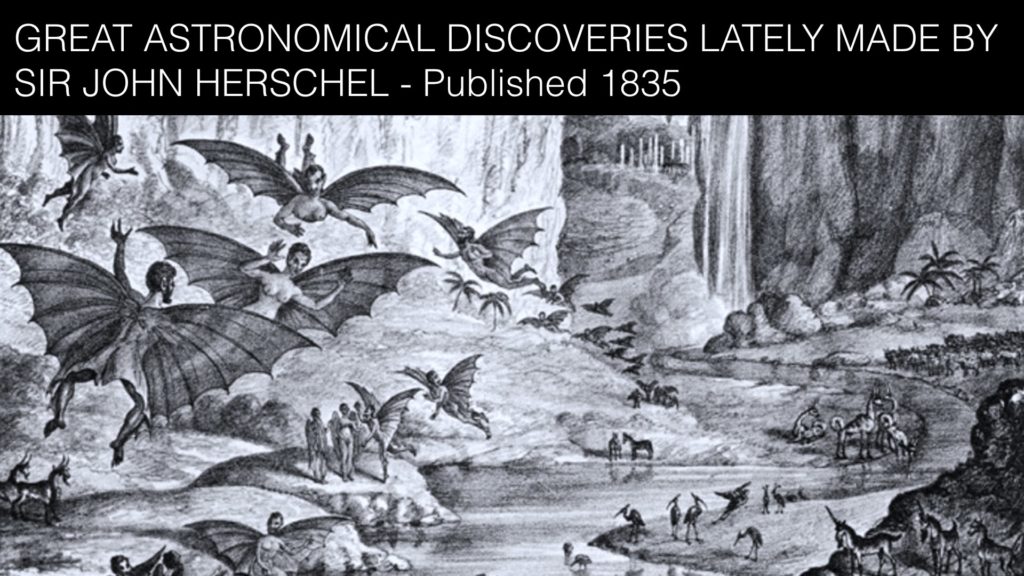

In 1895, a 6-part essay series was published in The Sun, talking about how astronomers had discovered life on the Moon. It includes vivid descriptions of an entire civilization – with buildings, amazing animals, and winged humans living in sophisticated cities.

The Sun claimed that these stories were so compelling it dramatically increased their circulation.

They didn’t retract the story for weeks!

We may laugh at this – but then surely we must also laugh at ourselves.

After all, we’ve created the next next level printing press: The Internet. Combined with social media and blogging platforms like WordPress, we’re suddenly in an environment where we went from 6 cents to publish a paper to 1 cent and now down to 0.0001 cents.

And with that, we’ve created fake news:

The Great Moon Hoax of 1835 isn’t much different than the various hoaxes and fake news of 2016. Not great.

This is an example of how technology has enabled successive generations of viral media content that’s of questionable truthiness. And even as we ponder what we’ve created recently, we have to start thinking about what technologies like VR might ultimately let us create. And how far photo and video manipulation will go, given the continued democratization of those technologies.

OK, the last growth topic we’re going to talk about is bootstrapping marketplaces:

This is an important and very old topic because humans have been trading since time immortal.

In fact, there’s evidence from prehistoric periods that there’s been long distance trade for over 150,000 years. Amazing!

So let’s dig into marketplaces:

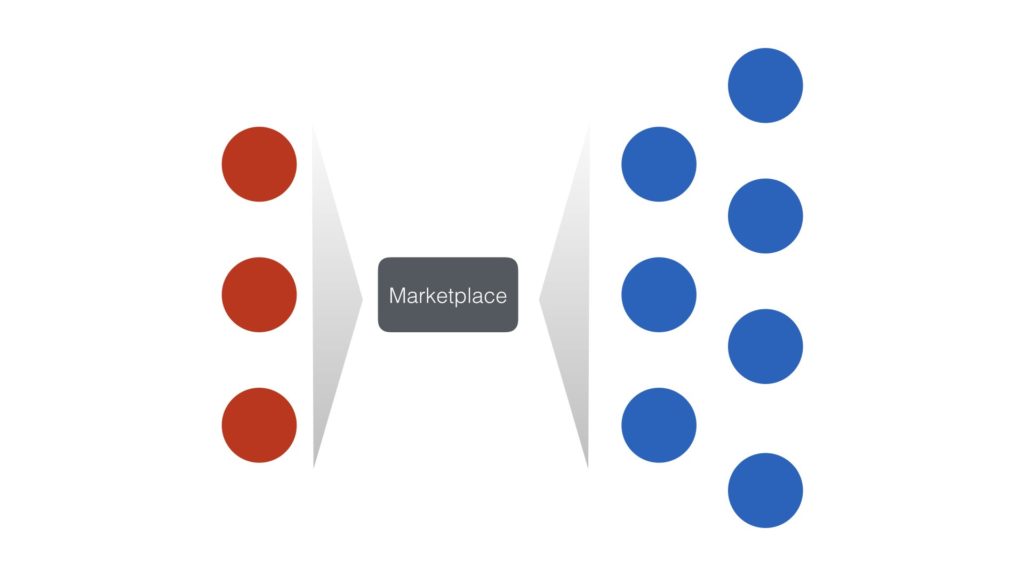

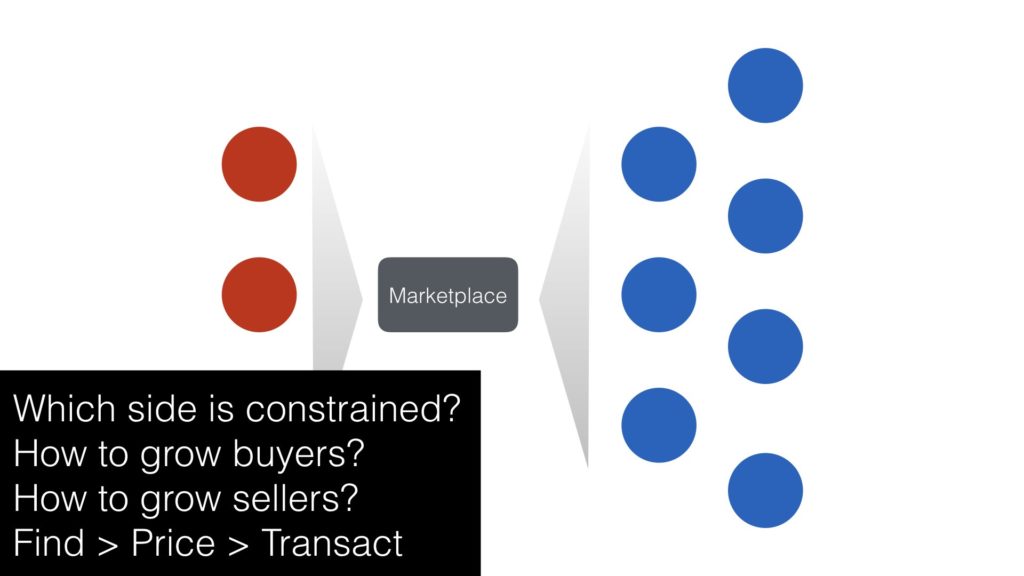

This is a diagram is showing a two-sided marketplace, where you have buyers and sellers meeting together to exchange goods.

No matter what the marketplace looks like, you have to answer a couple simple questions:

One side will always be constrained. Usually, it’s the supply side that’s hard to get, and as long as you have folks with goods/services, you can find buyers. After you understand that dynamic, you also have to figure out how to grow buyers and how to grow sellers. Both sides of the market are typically pretty hard.

Then there’s the middle piece, which is to help both sides find, price, and transact. If you just help do one step in the process but not the whole thing, this causes problems since the experience will be disjointed. That’s why it was natural for eBay to buy Paypal.

The central growth problem with marketplaces is, how do you get them spun up? They are wonderful businesses once the marketplace network effect is going. There’s strategies to solve that now, but as you might have guessed, we had pretty sophisticated tools to solve this back in the day.

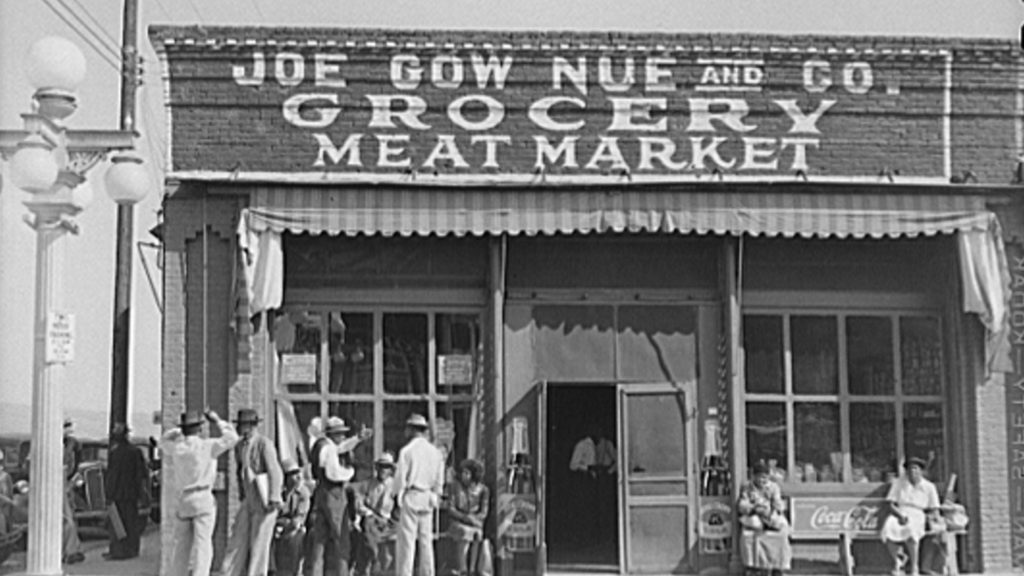

Let’s start this story with grocery stores:

Back in the day, local grocers were one major side of the marketplace that needed to be bootstrapped. If they didn’t carry your goods, you couldn’t get them in front of your customers. So how do you solve this? One of my favorite books is called My Life in Advertising by Claude Hopkins, written 100 years ago, talks about how they tackled this problem in a very clever way.

The first move was to invent the coupon:

Now, the coupon creates many important incentives. Obviously, it creates demand because then customers want to buy a product and try it out. The more nuanced effect is that it also stimulates the middlemen, the grocery stores, to carry the goods. The reason is that before you run a huge coupon marketing campaign, you can go to all the grocers and telegraph what’s going to happen

Here’s what to do: Just say, “a bunch of customers are coming to your stores for this new product, and if they don’t find it, they’re going to go to your competitors to find it instead.” Voila! By using money to generate some short-term momentum, it creates a Prisoner’s Dilemma for grocers to carry your goods. Then if your product is good, and customers keep coming back, then grocers will want to keep stocking, and your bootstrap problem is solved.

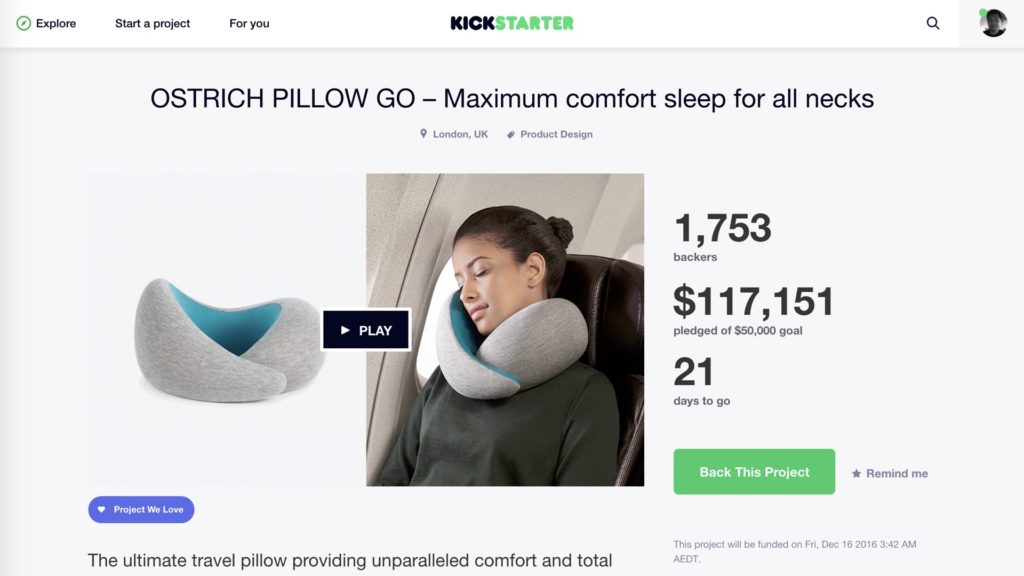

Now this is clever, but how clever is Kickstarter?

Isn’t Kickstarter and the various crowdfunding platforms really doing the same thing?

They help creators publish their products, drumming up demand, and with all the pre-orders, they’re able to convince a whole slew of ecosystem partners to help them: investors, manufacturers, retail partners, etc. The analogy is even more spot-on when you consider that they often give discounts to early backers of every product. In a way, this is just a coupon on something that doesn’t exist yet, to help bootstrap a market that would otherwise exist.

OK, so I hope you are enjoying all of these stories.

Truthfully, there are a ton of examples.

We can go on and on with examples like this. I also have some great notes on content marketing from 100 years ago – what else is the Michellin Guide for? And of press stunts. And may other examples.

After all, we’ve been at this game for a while.

The reason is that we’ve been convincing folks to buy stuff for a long, long time. Remember, humans have been trading with each other for 150,000+ years! Pretty sure that the first prehistoric cave-dwelling ancestor that could advertise their wares to their nearby communities got a major edge. And likely was the first to invent word-of-mouth marketing alongside fire!

But I want to make a broader point here:

Technology changes, but people stay the same. Human beings and our brains have been unchanged for a long time, which is why behavioral economics is so interesting – we’re susceptible to the same techniques whether it was delivered to our caveman brains or our modern brains.

And by the way, there’s a lot of techniques:

There’s so many marketing techniques that have been invented over time, and why they worked back in the day, work today, and will always work. While the platforms may have been different, many of these ideas were invented over 100 years ago. Even more, it’s obvious that these techniques will be relevant even 100 years from now! Or even 1000 years from now! Until we upload our brains to the cloud, we’ll still fundamentally refer friends for the same reasons, and find the same salacious articles compelling. Fake news will always work. :(

So when people ask “What’s next in growth?” they are often expecting an answer about technology when we should really be talking about people.

I can say with full certainty that growth opportunities will come from taking classic strategies – the stuff that’s been around for 100 years – that are fundamentally anchored on human behavior, and anchoring them on new platforms while executing well.

When it comes to new technologies, we’re talking about IoT. Wearables. Video. VR/AR. Smart TV. Autonomy. And much more…

And what a time to work on this problem. After all, technology is increasing faster and faster!

The rapid pace of technology adoption means that more and more platforms will be coming our way. And with each new platform, new opportunities will arise if we apply classic strategies and execute well.

So hats off to everyone betting their careers on VR/AR, drones, and all the new platforms coming out! It’ll take times, but there will be winners there.

In the end, if you find yourself still asking about what’s next, here’s some closing thoughts.

My challenge to everyone in the industry is simple. First, explore what’s come before us. Study the classics.

Ignore all the random noise out there in the world – all the tips and tricks that seem fun, but are actually the potato chips for our brains and careers. They taste good, can fill us up, but make us feel gross and aren’t nutritious.

Instead my guidance is simple:

If you think about new platforms, where they are in their maturity cycle, and are early when it counts, that’s great.

Much of the success of social products are due to them being first to email virality. And many of the winners within mobile were early to the smartphone platforms, which have now started to ossify.

Once you figure out the platforms, here’s where tactics can count. Execute thoughtfully and iteratively, so that you are learning about your product and platform. If you are prepared, and have mastered the tactics of the trade, then this is when you can shine.

This is the realm of A/B testing, funnel optimization, viral loop construction, building viral content, and creating sticky products. When you combine this with a new platform that’s all fresh powder, the results can be explosive.

And I want to also give a warning about growth hacks:

Nothing in this industry is ever easy. Tips and tricks aren’t enough. We have to think strategically and execute very well, over years and years to be successful.

What’s next in growth? It’s what’s come before, but combined with a dash of new tech :)

So again, the future of growth will combine a few factors:

- Classic strategies that are all about people

- New platforms that present big new opportunities

- Combined with iterative, thoughtful execution

We can learn from the past, because the things that worked 100 years ago, or even 1000 years ago, still work today.

Here’s another quick example:

After all, technology changes, but people stay the same.

Thank you! :)

Finally, as promised, here’s a video of this talk and here’s a PDF to download. The video is just under 30 minutes, so it’s a quick watch. If you want to learn more about the conference go here: Startcon. Thanks to Cheryl and Matt for having me there!

PS. Get new updates/analysis on tech and startupsI write a high-quality, weekly newsletter covering what's happening in Silicon Valley, focused on startups, marketing, and mobile.

Views expressed in “content” (including posts, podcasts, videos) linked on this website or posted in social media and other platforms (collectively, “content distribution outlets”) are my own and are not the views of AH Capital Management, L.L.C. (“a16z”) or its respective affiliates. AH Capital Management is an investment adviser registered with the Securities and Exchange Commission. Registration as an investment adviser does not imply any special skill or training. The posts are not directed to any investors or potential investors, and do not constitute an offer to sell -- or a solicitation of an offer to buy -- any securities, and may not be used or relied upon in evaluating the merits of any investment.

The content should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Any charts provided here are for informational purposes only, and should not be relied upon when making any investment decision. Certain information contained in here has been obtained from third-party sources. While taken from sources believed to be reliable, I have not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. The content speaks only as of the date indicated.

Under no circumstances should any posts or other information provided on this website -- or on associated content distribution outlets -- be construed as an offer soliciting the purchase or sale of any security or interest in any pooled investment vehicle sponsored, discussed, or mentioned by a16z personnel. Nor should it be construed as an offer to provide investment advisory services; an offer to invest in an a16z-managed pooled investment vehicle will be made separately and only by means of the confidential offering documents of the specific pooled investment vehicles -- which should be read in their entirety, and only to those who, among other requirements, meet certain qualifications under federal securities laws. Such investors, defined as accredited investors and qualified purchasers, are generally deemed capable of evaluating the merits and risks of prospective investments and financial matters. There can be no assurances that a16z’s investment objectives will be achieved or investment strategies will be successful. Any investment in a vehicle managed by a16z involves a high degree of risk including the risk that the entire amount invested is lost. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by a16z is available at https://a16z.com/investments/. Excluded from this list are investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets. Past results of Andreessen Horowitz’s investments, pooled investment vehicles, or investment strategies are not necessarily indicative of future results. Please see https://a16z.com/disclosures for additional important information.