Author Archive

What makes Sequoia Capital successful? “Target big markets”

Don Valentine, who founded Sequoia Capital, talks about what makes Sequoia Capital effective. It’s one of my favorite talks, and I find myself watching and re-watching it from time to time, and I’d encourage everyone to hear the wisdom themselves.

Markets, not team

In the beginning of the video, Don Valentine asks, why is Sequoia successful? He says that most VCs talk about how they finance the best and the brightest, but Sequoia focuses instead on the size of the market, the dynamics of the market, and the nature of the competition.

This is, of course, super interesting because in many ways it’s contrarian to the typical response that investing is all about “team.”

Creating markets versus exploiting markets

Another choice quote: “We’re never interested in creating markets – it’s too expensive. We’re interested in exploiting markets early.”

In consumer internet, when the divisions that separate product categories are so fuzzy, it can be hard to understand when you’re creating a market versus when you’re attacking an existing one. My rule of thumb is that:

If people know how to search for products in your category then you are in an existing market.

I’ve written more about this in posts here and here

Watch the video of Don Valentine of Sequoia capital on “Target Big Markets” on YouTube or in the embed below:

How to use Twitter to predict popular blog posts you should write

Using retweets to assess content virality

Recently I’ve been running an experiment:

- Tweet an insight, idea, or quote

- See how many people retweet it

- If it catches, then write a blog post elaborating on the topic

My recent Growth Hacker post was the result of one such tweet, which you can see above in my Crowdbooster dashboard. I wrote it on a whim, but after the retweets, I developed it into a longer and more comprehensive blog post. (Note that sometimes a tweet is not suitable to developed into a blog post, but most of the time this technique works)

Why this works

This works because the headline is key. It spreads the content behind it.

This is especially true on Twitter, but it’s also true for news sites that will pick up and syndicate your content. If that headline is viral and the content behind it is high quality, there’s a multiplier effect – sometimes a difference of 100X or more. Naturally, you want to optimize the flow of how people interact with your content, starting with what they see first: The title.

After all, what’s a better test for whether the following will be viral:

New blog post: Growth Hacker is the new VP Marketing [link]

than the tweet:

Growth Hacker is the new VP marketing

It’s a natural test.

I’ll also argue that if you can express the core of your idea in a short, pithy tweet, then that’s a good test for whether the underlying blog post will be interesting as well. Great tweets are often provocative insights or mesmerizing quotes, and there’s a lot to say by examining the issues more deeply. Contrast this to writing a long, unfocused, laundry-list essay examining a topic from all angles, taking no interesting positions or risks along the way – now that’s a recipe for boredom.

Combining virality with a high-quality product, of course, is the key to a lot of things – not just blogging :)

Don’t waste your time writing what people don’t want to read

Testing your ideas like this allows you to invest more time and effort into the content – a clear win.

Personally, I love writing long-form content that dives deep into an area, and also enjoy reading it as well. Unfortunately, writing a blog post often takes a long time – an hour or more. Use this technique to make it safer to spend more time, think more deeply, and research more broadly on you write. In my experience, writing a high-quality, highly retweetable blog post once per month is better than writing a daily stream of short, low-quality posts that no one will read. Plus, it takes less time.

As a smart guy once said: “Do less, but better.”

Quora: Has Facebook’s DAU/MAU always been ~50%?

I recently asked, and then answered my own question on Quora and wanted to share here as well.

Has Facebook’s DAU/MAU always been ~50%?

According to public info, Facebook’s DAU/MAU is 58% these days. Here’s a link.

It states:

- 901 million monthly active users at the end of March 2012

- 526 million daily active users on average in March 2012

Has Facebook’s DAU/MAU always been this good, as a consequence of its product category (communication/photo-sharing/etc.)? Or was it once a lot worse and was improved over time?

(UPDATE: Here’s a followup question I have about the same topic- Was Facebook’s DAU/MAU ~50% prior to launching the Newsfeed in 2009?)

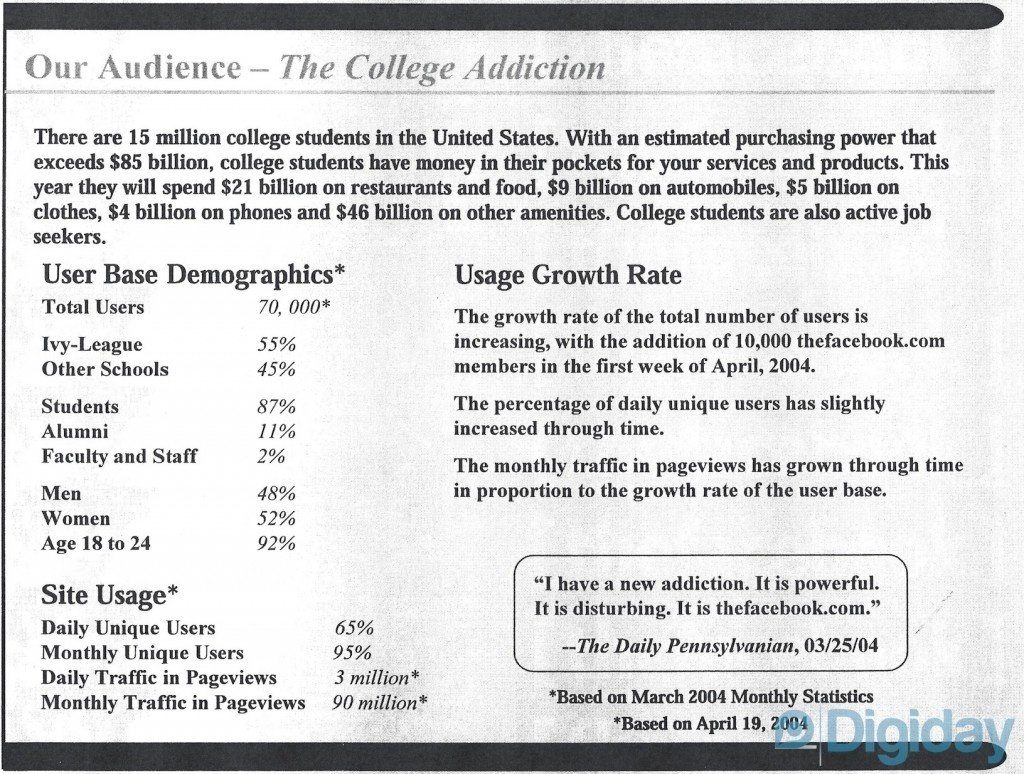

Answer: Yes, Facebook’s DAU/MAU has been close to 50%, at least since 2004.

Based on their media kit from 2004, their DAU/MAU was already 75%.

Since this media kit, their DAU/MAU data has been included in their financials since 2009. However, I theorize that Facebook’s DAU/MAU has always been high as a natural outcome of the communication-oriented usage of the product. Contrast this to a product category like ecommerce which you are unlikely to use and purchase with every day.

In their recent financial filings, the following chart is shown for Facebook’s DAU and MAU since 2009:

If you do a graph of the DAU/MAU on this data, since 2009, you’ll see that it starts around 45-47% and goes up to a very impressive 58% recently.

(As an aside, another interesting aspect is that Facebook’s MAU growth looks pretty much like a straight line, and so the % growth has been slowing down as of late. The MAU growth was around 23% starting in 2009, but is now down to 6-7% in recent months. See below for a graph on MAU vs % MAU growth)

How do I learn to be a growth hacker? Work for one of these guys :)

After writing my recent article on Growth Hackers, I’ve been asked by quite a few folks on how to learn the discipline. The best answer is, learn from someone who’s already good at it – if you’re technical and creative, it’s well worth the time.

I would encourage everyone to also read Andy Johns’s Quora answers on What is Facebook’s User Growth team responsible for and what have they launched? and

What are some decisions taken by the “Growth team” at Facebook that helped Facebook reach 500 million users?– it lays out a lot of the key activities used in a well-run growth team.

The list below includes some of these folks I know personally, some just by reputation- but collectively they’ve grown products up to millions, 10s of millions, and in some cases, 100M+ users. Typically they use quantitatively-oriented techniques centered on virality across different channels such as iOS, Facebook, email, etc. There’s lots of iteration, A/B testing, and experimentation involved. There’s also really great growth hackers centered around SEO, SEM/ad arb, and other techniques, but for the most part I’m just listing out the folks around quant-based virality. The important thing about virality is, it’s free :) So it’s an important skill for startups.

Missing from this list are many unsung heroes over at Zynga, Dropbox, Branchout, Viddy/Socialcam, lots of ex-Paypal/Slide people, etc., etc. Also, all of these guys typically have co-founders or entire growth teams around them that are experts, even if I don’t know them by name.

If others in the community would like to make suggestions, tweet me at @andrewchen or just reply in the comments.

| Name | Background | |

| Noah Kagan | AppSumo, Mint, Facebook | noahkagan |

| David King | Blip.me, ex-Lil Green Patch | deekay |

| Mike Greenfield | Circle of Moms, ex LinkedIn | mike_greenfield |

| Ivan Kirigin | Dropbox, ex-Facebook | ikirigin |

| Michael Birch | ex-Bebo, BirthdayAlarm | mickbirch |

| Blake Commegere | ex-Causes/Many games | commagere |

| Ivko Maksimovic | ex-Chainn/Compare People | ivko |

| Dave Zohrob | ex-Hot or Not, MegaTasty | dzohrob |

| Jia Shen | ex-RockYou | metatek |

| James Currier | ex-Tickle | jamescurrier |

| Stan Chudnovsky | ex-Tickle | stan_chudnovsky |

| Siqi Chen | ex-Zynga | blader |

| Ed Baker | esbaker | |

| Alex Schultz | alexschultz | |

| Joe Greenstein | Flixster | joseph77b |

| Yee Lee | yeeguy | |

| Josh Elman | Greylock, ex-Twitter | joshelman |

| Jamie Quint | Lookcraft, ex-Swipely | jamiequint |

| Elliot Shmukler | eshmu | |

| Aatif Awan | aatif_awan | |

| Andy Johns | Quora, Twitter, Facebook | ibringtraffic |

| Robert Cezar Matei | Quora, ex-Zynga | rmatei |

| Nabeel Hyatt | Spark, ex-Zynga | nabeel |

| Paul McKellar | SV Angel, ex-Square | pm |

| Greg Tseng | Tagged | gregtseng |

| Othman Laraki | othman | |

| Akash Garg | Twitter, ex-Hi5 | akashgarg |

| Jonathan Katzman | Yahoo, ex-Xoopit | jkatzman |

| Gustaf Alstromer | Voxer | gustaf |

| Jon Tien | Zynga | jontien |

UPDATE: My friend Dan Martell’s new company, Clarity, provides a way to access experts like this via phone and email. Here’s the directory of folks with expertise on growth.

Growth Hacker is the new VP Marketing

The rise of the Growth Hacker

The new job title of “Growth Hacker” is integrating itself into Silicon Valley’s culture, emphasizing that coding and technical chops are now an essential part of being a great marketer. Growth hackers are a hybrid of marketer and coder, one who looks at the traditional question of “How do I get customers for my product?” and answers with A/B tests, landing pages, viral factor, email deliverability, and Open Graph. On top of this, they layer the discipline of direct marketing, with its emphasis on quantitative measurement, scenario modeling via spreadsheets, and a lot of database queries. If a startup is pre-product/market fit, growth hackers can make sure virality is embedded at the core of a product. After product/market fit, they can help run up the score on what’s already working.

This isn’t just a single role – the entire marketing team is being disrupted. Rather than a VP of Marketing with a bunch of non-technical marketers reporting to them, instead growth hackers are engineers leading teams of engineers. The process of integrating and optimizing your product to a big platform requires a blurring of lines between marketing, product, and engineering, so that they work together to make the product market itself. Projects like email deliverability, page-load times, and Facebook sign-in are no longer technical or design decisions – instead they are offensive weapons to win in the market.

Get updates to this essay, and new writing on growth hacking:

The stakes are huge because of “superplatforms” giving access to 100M+ consumers

These skills are invaluable and can change the trajectory of a new product. For the first time ever, it’s possible for new products to go from zero to 10s of millions users in just a few years. Great examples include Pinterest, Zynga, Groupon, Instagram, Dropbox. New products with incredible traction emerge every week. These products, with millions of users, are built on top of new, open platforms that in turn have hundreds of millions of users – Facebook and Apple in particular. Whereas the web in 1995 consisted of a mere 16 million users on dialup, today over 2 billion people access the internet. On top of these unprecedented numbers, consumers use super-viral communication platforms that rapidly speed up the proliferation of new products – not only is the market bigger, but it moves faster too.

Before this era, the discipline of marketing relied on the only communication channels that could reach 10s of millions of people – newspaper, TV, conferences, and channels like retail stores. To talk to these communication channels, you used people – advertising agencies, PR, keynote speeches, and business development. Today, the traditional communication channels are fragmented and passe. The fastest way to spread your product is by distributing it on a platform using APIs, not MBAs. Business development is now API-centric, not people-centric.

Whereas PR and press used to be the drivers of customer acquisition, instead it’s now a lagging indicator that your Facebook integration is working. The role of the VP of Marketing, long thought to be a non-technical role, is rapidly fading and in its place, a new breed of marketer/coder hybrids have emerged.

Airbnb, a case study

Let’s use case of Airbnb to illustrate this mindset. First, recall The Law of Shitty Clickthroughs:

Over time, all marketing strategies result in shitty clickthrough rates.

The converse of this law is that if you are first-to-market, or just as well, first-to-marketing-channel, you can get strong clickthrough and conversion rates because of novelty and lack of competition. This presents a compelling opportunity for a growth team that knows what they are doing – they can do a reasonably difficult integration into a big platform and expect to achieve an advantage early on.

Airbnb does just this, with a remarkable Craigslist integration. They’ve picked a platform with 10s of millions of users where relatively few automated tools exist, and have created a great experience to share your Airbnb listing. It’s integrated simply and deeply into the product, and is one of the most impressive ad-hoc integrations I’ve seen in years. Certainly a traditional marketer would not have come up with this, or known it was even possible – instead it’d take a marketing-minded engineer to dissect the product and build an integration this smooth.

Here’s how it works at a UI level, and then we’ll dissect the technology bits:

(This screenshots are courtesy of Luke Bornheimer and his wonderful answer on Quora)

Looks simple, right? The impressive part is that this is done with no public Craigslist API! It turns out, you have to look closely and carefully at Craigslist in order to accomplish an integration like this. Note that it’s 100X easier for me to reverse engineer something that’s already working versus coming up with the reference implementation – and for this reason, I’m super impressed with this integration.

Reverse-engineering “Post to Craigslist”

The first thing you have to do is to look at how Craigslist allows users to post to the site. Without an API, you have to write a script that can scrape Craigslist and interact with its forms, to pre-fill all the information you want.

The first thing you can notice from playing around with Craigslist is that when you go to post something, you get a unique URL where all your information is saved. So if you go to https://post.craigslist.org you’ll get redirected to a different URL that looks like https://post.craigslist.org/k/HLjRsQyQ4RGu6gFwMi3iXg/StmM3?s=type. It turns out that this URL is unique, and all information that goes into this listing is associated to this URL and not to your Craigslist cookie. This is different than the way that most sites do it, where a bunch of information is saved in a cookie and/or server-side and then pulled out. This unique way of associating your Craigslist data and the URL means that you can build a bot that visits Craigslist, gets a unique URL, fills in the listing info, and then passes the URL to the user to take the final step of publishing. That becomes the foundation for the integration.

At the same time, the bot needs to know information to deal with all the forms – beyond filling out the Craigslist category, which is simple, you also need to know which geographical region to select. For that, you’d have to visit every Craigslist in every market they serve, and scrape the names and codes for every region. Luckily, you can start with the links in the Craiglist sidepanel – there’s 100s of different versions of Craigslist, it turns out.

If you dig around a little bit you find that certain geographical markets are more detailed than others. In some, like the SF Bay Area, there’s subareas (south bay, peninsula, etc.) and neighborhoods (bernal, pacific heights) whereas in other markets there’s only subareas, or there’s just the market. So you’d have to incorporate all of that into your interface.

Then there’s the problem of the listing itself – by default, Craigslist works by giving you an anonymous email address which you use to communicate to potential customers. If you want to drive them to your site, you’d have to notice that you can turn off showing an email, and just provide the “Contact me here” link instead. Or, you could potentially fill a special email address like listing-29372@domain.com that automatically directs inquiries to the right person, which can be done using services like Mailgun or Sendgrid.

Finally, you’ll want the listing to look good – it turns out Craigslist only supports a limited amount of HTML, so you’ll need to work to make your listings work well within those constraints.

Completing the integration is only the beginning – once it’s up, you’d have to optimize it. What’s the completion % once sometime starts sharing their listing out to Craigslist? How can you change the flow, the call to action, the steps in the form, to increase this %? And similarly, when people land from Craigslist, how do you make sure they are likely to complete a transaction? Do they need special messaging?

Tracking all of this requires additional work with click-tracking with unique URLs, 1×1 GIFs on the Craigslist listing, and many more details.

Long story short, this kind of integration is not trivial. There’s many little details to notice, and I wouldn’t be surprised if the initial integration took some very smart people a lot of time to perfect.

No traditional marketer would have figured this out

Let’s be honest, a traditional marketer would not even be close to imagining the integration above – there’s too many technical details needed for it to happen. As a result, it could only have come out of the mind of an engineer tasked with the problem of acquiring more users from Craigslist. Who knows how much value Airbnb is getting from this integration, but in my book, it’s damn impressive. It taps into a low-competition, huge-volume marketing channel, and builds a marketing function deeply into the product. Best of all, it’s a win-win for everyone involved – both the people renting out their places by tapping into pre-built demand, and for renters, who see much nicer listings with better photos and descriptions.

This is just a case study, but with this type of integration, a new product is able to compete not just on features, but on distribution strategy as well. In this way, two identical products can have 100X different outcomes, just based on how well they integrate into Craigslist/Twitter/Facebook. It’s an amazing time, and a new breed of creative, technical marketers are emerging. Watch this trend.

So to summarize:

- For the first time ever, superplatforms like Facebook and Apple uniquely provide access to 10s of millions of customers

- The discipline of marketing is shifting from people-centric to API-centric activities

- Growth hackers embody the hybrid between marketer and coder needed to thrive in the age of platforms

- Airbnb has an amazing Craigslist integration

Good luck, growth hackers!

Google+ and the curse of instant distribution

I was reading today’s NYT article on Google+’s new redesign and found myself continually puzzled by the key metric Google continues to report as the success of their new social product: Registered Users.

In the very first sentence, Vic Gundotra writes:

More than 170 million people have upgraded to Google+, enjoying new ways to share in Search, Gmail, YouTube and lots of other places.

The use of registered users is a vanity metric, and reflects how easily Google can cross-sell any new product to their core base of 1 billion uniques per month. What it doesn’t reflect, however, is the actual health of the product.

Ultimately, this misalignment of metrics is due to the curse of instant distribution. Because Google can cross-sell whatever products they want against their billion unique users, it’s easy to grade on that effort. Plus it’s a big number, who doesn’t love a big number?

Google+ should be measured on per user metrics

Here’s what metrics are more important instead: Given the Google+ emphasis on Circles and Hangouts, you’d think that the best metrics to use would evaluate the extent to which these more personal and more authentic features are being used. These would include metrics like:

- Shares per user per day (especially utilizing the Circles feature)

- Friends manually added to circles per user per day (not automatically!)

- Minutes of engagement per user per day

Point is, the density and frequency of relationships within small circles ought to matter more than the aggregate counts on the network. As I’ve blogged about before, you use metrics to reflect the strategy you already have in place, and based on the Google+’s focus on authentic circles of friends, you’d think the metrics would focus on the density of friendships and activities, and not the aggregate numbers.

The curse of instant distribution

Every new product for a startup goes through a gauntlet to reach product/market fit, and then traction. In the real world, product quality and the ability to solve a real problem for people ends up correlating with your ability to distribute the product. Google+ is blessed, and cursed, with the ability to sidestep this completely. They are able to onboard hundreds of millions of users without having great product/market fit, and can claim positive metrics without going through the gauntlet of really making their product work.

Adam D’Angelo of Quora (and previously CTO of Facebook) wrote this insightful commentary regarding Google Buzz a while back:

Why have social networks tied to webmail clients failed to gain traction?

Personally I think this is mostly because the social networking products built by webmail teams haven’t been very good. Even Google Buzz, which is way ahead of the attempts built into Yahoo Mail and Hotmail, has serious problems: the connections inside it aren’t meaningful, profiles and photos are second class, comments bump items to the top of the feed meaning there’s old stuff endlessly getting recycled, and the whole product itself is a secondary feature accessible only through a click below the inbox, which hasn’t gotten it enough distribution to kick off and sustain conversations.I’m pretty sure that if Google, Microsoft, or Yahoo had cloned Facebook almost exactly (friends, profiles, news feed, photos) and integrated it well into their webmail product, that it could have taken off (before Facebook got to its current scale; at this point it will be hard for any competitor, even with a massive distribution channel pushing it).

So I think this question is really, why are social networks that webmail teams build always bad? Here’s my guess:

- The team building the social network knows that they’re going to get a huge amount of distribution via the integration and so they aren’t focused on growth and making a product that people will visit on their own.

- Integrating any two big products is really hard.

- Any big webmail provider is going to have a big organization behind it, and lots of politics and compromises probably make it difficult to execute well.

- Teams that work on webmail products have gotten good at building a webmail product, and haven’t selected for the skills and culture that a team that grows around building a social network will have.

(The bolding is from me). I couldn’t agree more with this answer. I think a key lesson behind the recent success of products like Instagram and Pinterest is that there’s still a lot of room in the market for great social products to take off- but the emphasis has to be on the product rather than the superficial act of onboarding a lot of new users into Google+.

Ultimately, it comes down to how realistic the Google+ folks are in looking at their metrics. If they drink their own kool-aid and think they have product/market fit when it’s in fact the traction is solely dependent on the power of their distribution channels, they may never get their product working.

On the other hand, if they have a balanced view on their metrics and know they don’t have product/market fit yet, then they have a fighting chance. Unfortunately, I think the changes they’ve made to the product recently are more efforts to optimize, rather than fundamental improvements to the product. I think Google+ needs much bigger changes to make it as engaging as the best social products.

The Law of Shitty Clickthroughs

The first banner ad ever, on HotWired in 1994, debuted with a clickthrough rate of 78% (thanks @ottotimmons)

First it works, and then it doesn’t

After months of iterating on different marketing strategies, you finally find something that works. However, the moment you start to scale it, the effectiveness of your marketing grinds to a halt. Sound familiar?

Welcome to the Law of Shitty Clickthroughs:

Over time, all marketing strategies result in shitty clickthrough rates.

Here’s a real example – let’s compare the average clickthrough rates of banner ads when debuted on HotWired in 1994 versus Facebook in 2011:

- HotWired CTR, 1994: 78%

- Facebook CTR, 2011: 0.05%

That’s a 1500X difference. While there are many factors that influence this difference, the basic premise is sound – the clickthrough rates of banner ads, email invites, and many other marketing channels on the web have decayed every year since they were invented.

Here’s another channel, which is email open rates over time, according to eMarketer:

While this graph shows a decline, the other graph (which I don’t have handy) is that the number of emails sent out has increased up to 30+ billion per day.

All these channels are decaying over time, and what’s saving us is the new marketing channels are constantly getting unveiled, too. These new channels offer high performance, because of a lack of competition, big opportunities for novel marketing techniques, and these days, the cutting edge is about optimizing your mobile notifications, not your banner placements.

There are a few drivers for the Law of Shitty Clickthroughs, and here’s a summary of the top ones:

- Customers respond to novelty, which inevitably fades

- First-to-market never lasts

- More scale means less qualified customers

Novelty

Without a doubt, one of the key drivers of engagement for marketing is that customers respond to novelty. When HotWired showed banner ads for the first time in history, people clicked just to check out the experience. Same for being the first web product to email people invites to a website – it works for a while, until your customers get used to the effect, and start ignoring it.

One of the most important tools you have at your disposal is the creative and calls to action that you use in your marketing – this might be like “X has invited you to Y” or it might be the headline you use in your banner ads. Recently, Retargeter posted an interesting analysis on the Importance of Rotating Creatives, which showed how keeping the same ad creative led to declining CTRs over time:

Publishers often have a similar problem in consumers ignoring the advertising on their site, which drives down clickthrough rates for both of them (bad for CPMs). This problem is often described as banner blindness, and you can see it clearly here in an eye-tracking study by Jakob Nielsen:

You can see here how users, almost comically, avoid looking at any banners.

The point is, humans seek novelty yet are pattern-recognition machines. Your initial marketing strategy will work quite well as your users try it for the first time, but afterwards, they learn to filter your marketing efforts out unless they are genuinely useful (more on that later).

First-to-market never lasts

It’s bad enough that your own marketing efforts drive down channel performance, but usually once your marketing efforts are working, your competitors quickly follow. There’s a whole cottage industry of companies that provide competitive research in the area of how their competitors are advertising and give you the information needed to fast-follow their marketing efforts.

For example, with a quick query, I know how much Airbnb is spending on search marketing (turns out, millions per year) what keywords they are buying ads on, and who their competitors are. And this is just a free service! There are much more sophisticated products for every established marketing channel:

Airbnb Search Engine Marketing

- Daily ad budget: $10,638

- Keywords: 62,729

- Example ad: Find Affordable Rooms Starting From $20/Day. Browse & Book Online Now!

- Main competitors: Expedia.com, booking.com, hotels.com, Marriott.com

Any clone of their business can quickly fast-follow their marketing efforts and use the same ads in the same marketing channels. This quickly degrades the performance of the marketing channel as the novelty wears off and clickthroughs plummet.

Any product that is first to market has a limited window where they will enjoy unnaturally high marketing performance, until the competition enters, in which case everyone’s marketing efforts will degrade.

More scale means less qualified customers

Another important way to think about the available market for your product is in terms of the popular Technology Adoption Lifecycle, in which early adopters actively seek out your product, while the rest of the mainstream market needs a lot of convincing. The quant marketing way to look at this is that early adopters respond better to marketing efforts across any given metric (signup %, CTR, CPA) than the later customer segments. In the TAL framework, the early market seeks out novelty, whereas the mainstream market just cares if you solve a problem for them.

As a result, a marketing strategy focused on early adopters is bound to look better than what you get later. You can get some limited traffic from PR and targeted advertising from niche communities and media properties. However once you get past this group, the CTRs can drop substantially.

If you’re a SaaS or ecommerce company that’s road-tested your marketing strategy by acquiring limited batches of customers, the problem is that whatever assumptions and projections you make off of this base end up fundamentally skewed positive. If your model indicates that you can acquire customers at $10 and break even within 6 months, it’s not hard for a 30% increase in CAC and 30% decrease in LTV to double the time it takes to get to profitability. This could be the difference between life and death for a company.

Lesson to investors is: Beware marketing metrics done at a small scale, and beware marketing tech companies that facilitate momentary marketing opportunities without a bigger vision. These are arbitrage opportunities that will disappear over time.

How to fight the Law of Shitty Clickthroughs

I call it a Law, of course, because I really believe it’s a strong gravitational pull on all marketing on the web. You can’t avoid it, and in many ways, it’s counter productive to try.

You can always get incrementally better performance out of your marketing by taking a nomad strategy – always keep developing new creative, testing new publishers, and so on. That’s all easy, but is mostly about maintaining some base level of performance. This can push the Law of Shitty Clickthroughs to act over years rather than degrading your marketing efforts over months.

Similarly, this law provides a litmus test as to the difference between advertising and information. When you are marketing with useful information, then CTRs stay high. Advertising that’s just novelty and noise wrapped in a new marketing channel has a limited shelf life.

The real solution: Discover the next untapped marketing channel

The 10X solution to solving the Law of Shitty Clickthroughs, even momentarily, is to discover the next untapped marketing channel. In addition to doubling down on traditional forms of online advertising like banners, search, and email, it’s important to work hard to get to the next marketing channel while it’s uncontested.

Sometimes I get asked “have you ever seen someone do XYZ to acquire customers?” Turns out, the highest vote of confidence I can give is, “No I haven’t, and that’s good – that means there’s a higher chance of it working. You should try it.”

Today, these (relatively) uncontested marketing channels are Open Graph, mobile notifications, etc. If you can make these channels work with a strong product behind it, then great. Chances are, you’ll enjoy a few months if not a few years of strong marketing performance before they too, slowly succumb.

Visual Basic, PHP, Rails. Is Node.js next?

I had a nerdy conversation on what might be the next mainstream framework for building web products, and in particular whether the node.js community would ultimately create this framework, or if node.js will just be a fad. This blog post is a bit of a deviation from my usual focus around marketing, so just ignore if you have no interest in the area.

Here’s the summary:

- Programming languages/frameworks are like marketplaces – they have network effects

- Rails, PHP, and Visual Basic were all successful because they made it easy to build form-based applications

- Form-based apps are a popular/dominant design pattern

- The web is moving to products with real-time updates, but building real-time apps hard

- Node.js could become a popular framework by making it dead simple to create modern, real-time form-based apps

- Node.js will be niche if it continues to emphasize Javascript purity or high-scalability

The longer argument below:

Large communities of novice/intermediate programmers are important

One of the biggest technology decisions for building a new product is the choice of development language and framework. Right now for web products, the most popular choice is Ruby on Rails – it’s used to build some of the most popular websites in the world, including Github, Scribd, Groupon, and Basecamp.

Programming languages are like marketplaces – you need a large functional community of people both demanding and contributing code, documentation, libraries, consulting dollars, and more. It’s critical that these marketplaces have scale – it needs to appeal to the large ecosystem of novices, freelancers and consultants that constitute the vast majority of programmers in the world. It turns out, just because a small # of Stanford-trained Silicon Valley expert engineers use something doesn’t guarantee success.

Before Rails, the most popular language for the web was PHP, which had a similar value proposition – it was easy to build websites really fast, and it was used by a large group of novice/intermediate programmers as well. This includes a 19-yo Mark Zuckerberg to build the initial version of Facebook. Although PHP gained the reputation of churning out spaghetti code, the ability for people to start by writing HTML and then start adding application logic all in one file made it extremely convenient for development.

And even before Rails and PHP, it was Visual Basic that engaged this same development community. It appealed to novice programmers who could quickly set up an application by dragging-and-dropping controls, write application logic with BASIC, etc.

I think there’s a unifying pattern that explains much of the success of these three frameworks.

The power of form-based applications

The biggest “killer app” for all of these languages is how easy it is to build the most common application that mainstream novice-to-intermediate programmers are paid to build: Basic form-based applications.

These kinds of apps let you do a some basic variation of:

- Give the user a form for data-entry

- Store this content in a database

- Edit, view, and delete entries from this database

It turns out that this describes a very high % of useful applications, particularly in business contexts including addressbooks, medical records, event-management, but also consumer applications like blogs, photo-sharing, Q&A, etc. Because of the importance of products in this format, it’s no surprise one of Visual Basic’s strongest value props was a visual form building tool.

Similarly, what drove a lot of the buzz behind Rails’s initial was a screencast below:

How to build a blog engine in 15 min with Rails (presented in 2005)

Even if you haven’t done any programming, it’s worthwhile to watch the above video to get a sense for how magical it is to get a basic form-based application up and running in Rails. You can get the basics up super quickly. The biggest advantages in using Rails are the built-in data validation and how easy it is to create usable forms that create/update/delete entries in a database.

Different languages/frameworks have different advantages – but easy form-based apps are key

The point is, every new language/framework that gets buzz has some kind of advantage over others- but sometimes these advantages are esoteric and sometimes they tap into a huge market of developers who are all trying to solve the same problem. In my opinion, if a new language primarily helps solve scalability problems, but is inferior in most other respects, then it will fail to attract a mainstream audience. This is because most products don’t have to deal with scalability issues, though there’s no end to programmers who pick technologies dedicated to scale just in case! But much more often than not, it’s all just aspirational.

Contrast this to a language lets you develop on iOS and reach its huge audience – no matter how horrible it is, people will flock to it.

Thus, my big prediction is:

The next dominant web framework will be the one that allows you to build form-based apps that are better and easier than Rails

Let’s compare this idea with one of the most recent frameworks/languages that has gotten a ton of buzz is node.js. I’ve been reading a bit about it but haven’t used it much – so let me caveat everything in the second half with my post with that. Anyway, based on what I’ve seen there’s a bunch of different value props ascribed to its use:

- Build server-side applications with Javascript, so you don’t need two languages in the backend and frontend

- High-performance/scalability

- Allows for easier event-driven applications

A lot of the demo applications that are built seem to revolve around chat, which is easy to build in node but harder to build in Rails. Ultimately though, in its current form, there’s a lot missing from what would be required for node.js to hit the same level of popularity as Rails, PHP, or Visual Basic for that. I’d argue that the first thing that the node.js community has to do is to drive towards a framework that makes modern form-based applications dead simple to build.

What would make a framework based on node.js more mainstream?

Right now, modern webapps like Quora, Asana, Google Docs, Facebook, Twitter, and others are setting the bar high for sites that can reflect changes in data across multiple users in real-time. However, building a site like this in Rails is extremely cumbersome in many ways that the node.js community may be able to solve more fundamentally.

That’s why I’d love to see a “Build a blog engine in 15 minutes with node.js” that proves that node could become the best way to build modern form-based applications in the future. In order to do this, I think you’d have to show:

- Baseline functionality around scaffolding that makes it as easy as Rails

- Real-time updates for comment counts, title changes, etc that automatically show across any viewers of the blog

- Collaborative editing of a single blog post

- Dead simple implementation of a real-time feed driving the site’s homepage

All of the above features are super annoying to implement in Rails, yet could be easy to do in node. It would be a huge improvement.

Until then, I think people will still continue to mostly build in Rails with a large contingent going to iOS – the latter not due to the superiority of the development platform, but rather because that’s what is needed to access iOS users.

UPDATE: I just saw Meteor on Hacker News which looks promising. Very cool.

Quora: Will CPE (Cost Per Engagement) advertising ever take off?

Will CPE (Cost Per Engagement) advertising ever take off?

I doubt it – the reason is that it’s targeting metrics at the kind of marketers that don’t care too much about metrics.

Broadly speaking, there’s two kind of marketers in the world – a ton could be written about this, so I’ll just provide some sweeping generalizations:

Direct response marketers are companies that are typically very focused on ROI when they buy advertising – often these include companies you’ve never heard of in ecommerce, online dating, financial services, etc., where it’s easy to calculate the value of a customer and they are primarily getting their traffic through paid marketing channels. They like to back everything out to ROI by comparing lifetime value to cost per customer, and if not that, then at least cost-per-action or some similarly concrete metric.

In many cases, these kinds of marketers prefer search marketing, email marketing, telesales, and other things where it’s easy to quantify what’s going on – they stay away from Super Bowl ads though. They prefer CPA and CPC versus CPM or sponsorships.

Brand marketers are companies you’ve heard of and have seen a lot of advertising for – they are typically targeting a large consumer base, they want to position their products differently relative to their competition and don’t have great ways to quantify the value of a customer. For example, Coca-Cola doesn’t know the LTV of a customer nor what the cost-per-customer looks like for a billboard ad they’ve bought.

For these guys, they are used to hiring big ad agencies to help them advertise on billboards, television, the front page of Yahoo, etc. They may buy search marketing, but have different goals than ROI. (For example, they may just want the top ad, and don’t care too much about ROI)

Why CPE is a weird metric for both DR and brands

The reason why cost-per-engagement is a weird metric is that ROI-focused marketers (that is, direct response marketers), don’t care about “engagement.” They want to know if people are going to buy, and if their media spend is going to be profitable.

As a result, the “E” part of CPE is really only a part that brands care about. And yet, they don’t care that much about CPE because they aren’t focused on the cost of the campaign as the #1 priority. Instead, it’s more important where the ads are being placed, how strong the ad creative is being used, etc.

One scenario to demonstrate this: If they could buy the front page of YouTube, even if that had a higher CPE, a brand advertiser would be happier with that than being shown in random footers of YouTube (the “remnant”) even at a lower CPE. They are looking to establish their brand, not optimize their spend.

What will be prevalent instead?

I think even with the advent of lots of ad opportunities on social sites, the dominate business model will still be CPM/sponsorships for brand advertisers, and CPC/CPA for direct response. Basically, nothing much will change.

If it turns out that CPE correlates to CPA/CPC, then DR marketers will end up liking it.

Also, CPE might turn into a secondary metric that you use alongside really strong placement of ads- maybe as a way to establish a bonus or upside on the campaign, but I don’t think it’ll ever happen that the dominant form of advertising on the web will be that ad agencies will put in a CPE “bid” into self-serve systems :)

I answered this question on Quora – more great answers over there.

Why I doubted Facebook could build a billion dollar business, and what I learned from being horribly wrong

Facebook, early 2006

Sometimes, you need to be horribly, embarrassingly wrong to remind yourself to keep an open mind. This is my story of my failure to understand Facebook’s potential.

In 2006, I was working on a new ad network business that experimented a lot with targeting ads with social network data, broadly known as “retargeting” now. The idea was that we’d be able to take your interests and target advertising towards them, which would lead to higher CPMs. As part of this project, we did a meeting with Facebook when they were ~12 people. I had read bits and pieces about the company in the news, but since I was a few years out of college, I hadn’t used their product much. We got a meeting and since I was based in Seattle at the time, I flew down with some coworkers and chatted with them at their new office in Palo Alto.

We met the Facebook team at their office right next to the Sushitomo on University Ave. The place looked like a frat house – a TV and video game console on the ground, clothes and trash everywhere – the result of a handful of young people working very hard. After waiting a few minutes, we were escorted into a meeting room where we met with Sean Parker, Matt Cohler, and Mark Zuckerberg. Sean led the meeting, and told us a lot about Facebook, the amazing job he did raising their recent VC round from Accel, and all the good things that were happening at the company. Mark and the other folks there didn’t say a thing.

Ultimately, we didn’t get to work with them though we did eventually sign 1000s of publishers including MySpace, AOL, Wall St. Journal, NY Times, and others. But that meeting opened my eyes and convinced me of a horribly wrong thing: Facebook would never be a billion dollar company.

The metrics for Facebook – high growth, very low CPMs

As part of our meeting, we talked a bit about the metrics around Facebook, and I was immediately struck by a few things:

- Facebook was growing fast- very fast, and impressively handled by a super young team (like me!) sitting on a site with millions of uniques/month

- Their CPMs were terrible, lower than $0.25 (the revenue earned per thousand ad impressions) and the site was covered (at the time) with crappy remnant ads like online poker, dating, mortgages, etc. (ironically, which we now associate with MySpace)

- They didn’t know much about advertising, and that their CPMs were really bad and unlikely to improve- their monetization strategy seemed superficial at best

From these numbers, I did a quick calculation:

$0.25 CPM * 5 billion ad impressions per month max?

= $1.25M/month = $15M/year = $150-300M value business?

I figured that Facebook hitting 5B ads/month would be incredible – after all, it was just a college social network, right? Hitting 5B impressions/month would make Facebook bigger than our largest client at the time, ESPN.com, a top 10 internet property. The only thing larger were big portals like Yahoo, MSN, and AOL. The idea that Facebook would one day be bigger than all the portals never crossed my mind.

I was confident especially in the CPM number staying low because I had multiple proprietary datapoints from across the industry – from MySpace, Friendster, Hi5, Dogster, and many other social networks. I was convinced that I had a unique understanding about Facebook’s true potential – that convinced me even more that it could never be big.

And of course, I was totally, horribly wrong :)

The case at Yahoo for buying Facebook

While I was doing these calculations after my meeting, Yahoo was also doing a similar analysis on the value of Facebook for their ill-fated attempt at buying the company. I would first read about it in the WSJ, but later saw this fascinating slide on Techcrunch.

The slide below starts out with a projection of how many registered users Facebook had at the time and projected very logically what it would mean for them to saturate more of the core userbase of “high school and young adult” – I’m sure at the time, these felt like aggressive projections to ultimately be able to justify a big purchase price:

If you look at these numbers and compare them to what really happened, it’s pretty hilarious. Comparing their projected 2010E and what actually happened, they were only off by a few hundred million users!

Furthermore, I would say that even the Yahoo numbers were very optimistic about the increase from CPM going from $0.25 to >$5 over time. There were a lot of problems with brand advertisers putting themselves next to user-generated content that had not been worked out, and these numbers would have also ultimately involved Facebook doing homepage takeovers and such. And in fact, it’s true that no large user-generated content or social networking site has been able to generate CPMs close to the $5 level, at scale.

So what was wrong with my reasoning?

Ultimately, all my conclusions were wrong by several orders of magnitude – Facebook would go on to become the #1 site on the internet and would break all attempts at reasoning based on historical datapoints, interpolation, expert opinions, etc.

To contrast how silly my reasoning turned out to be:

My 2006 prediction: Facebook would max out at 3-5B pageviews/month

Reality: Facebook is at 1 trillion pageviews/month, and growing

I was ultimately right on the CPMs not improving by much, but it didn’t matter because I was off by 200-300x on pageviews/month! Total fail. The big insight, of course, was that Facebook wouldn’t just stay a social network for college students – ultimately the product targeted the market of everyone in the world. Confined within this the college niche, the idea that Facebook would one day reach a trillion pageviews per month seemed ludicrous. But because of the vision of the founding team, Facebook broke through this niche to build a new product that the world had never seen, and got to the numbers I had never predicted.

The most exceptional cases defy simple pattern-matching

As I mentioned in my previous post on group think vs innovation in Silicon Valley, there’s a strange contradiction between the mental tools we use to analyze and categorize businesses versus what it looks like when there’s an exceptional company that takes off. Pattern matching, deductive reasoning, and expert opinion tell you how things work in the “typical” case, but of course, we’re not interested in the typical case – we’re trying to find the exceptional ones, the rocketship companies that define the startup landscape.

That’s exactly when our logical reasoning and historically-based reasoning fails us the most.

For example, after years of failures from the entire category of social shopping sites like ThisNext, Kaboodle, and others, Pinterest has become the hottest company of the year. After years of Google impressing upon all of us that every startup needed to have an algorithm called X-rank and a 10X technology advantage, a simplistic webapp known as Twitter would emerge. And after 10 VC-funded search companies were started, and people at Yahoo thought search was a loss-leading feature that would best be outsourced, Google emerged. The list goes on and on.

Legendary VC Mike Moritz, who invested in Google/Yahoo/PayPal/Apple/etc has a relevant quote here:

I rarely think about big themes. The business is like bird spotting. I don’t try to pick out the flock. Each one is different and I try to find an interestingly complected bird in a flock rather than try to make an observation about an entire flock. For that reason, while other firms may avoid companies because they perceive a certain investment sector as being overplayed or already mature, Sequoia is “careful not to redline neighborhoods.

There’s a lot to be said for investing in the ugly duckling. When Don Valentine led Sequoia Capital’s investment in Cisco, many others had passed on the husband and wife founding team of Len Bosack and Sandy Lerner.

Never has a more profound thing been said about birdspotting :)

The biggest lesson I took away

The concrete lesson to be learned from this is: In the modern era, business models are a commodity. I never want to hear about people asking, “But what’s their business model?” because in a world where you can grow a userbase of 1 billion in a few years, displaying remnant ads and getting a $0.25 CPM will do. Or just throw some freemium model on it, and monetize 1% of them. If you can build the audience, you can build a big business.

The more abstract lesson to learn is: Be humble, and keep an open mind towards weird new companies. After a few years in Silicon Valley, you can gather a lot of useful heuristics about what’s worked and what doesn’t work. That will help you most of the time, but when it comes to the exceptional cases, all bets are off. So keep your mind open to weird, young companies that you meet that don’t fit the established pattern: Maybe the founders will all be recent MBAs, or be a spinout from a stodgy old corporation. Or maybe it’ll be in a slow-moving market, or it’ll be a married couple, or there’s 10 founders, or some other stereotypically bad thing. Remember that you’re helping/investing/working for the company right in front you, not a mutual fund of all companies with that characteristic!

If you had looked at social networking companies as a group, as I did, you would have found a flock of companies with questionable business models. However, if you had been prescient enough to pick out Facebook specifically, then you would have seen a company break through all historic precedents and become a huge success. Hats off to all 12 employees I met that day in 2006.

How sheep-like behavior breeds innovation in Silicon Valley

Once you’ve been working in Silicon Valley for a bit, you’re often offered advice such as:

- Are you launching at X conference? … where X is whatever hot conference is coming up, like SXSW or Launch

- Do you have an X app? … where X is whatever new platform just emerged, be it Open Social, iPhone, or whatever

- Have you pitched X venture capitalist? … where X is a prolific headline-grabbing investor with a recent hot deal

- You should do feature X that company Y does! … where X is some sexy (but possibly superficial feature) that a hot startup has done

- Do you know what your X metric is? … where X is some metric a recent blog post was written about

- Have you met X? … where X is some highly connected expert in the field

- Maybe you should pivot into X space! … where X is a space with a hot company that just raised a ton of funding

- Did you think about applying framework X to this? … where X is a new framework, be it gamification or viral loops or Lean

Sound familiar? I confess that I’ve both received and given much advice along the lines of the above. I call it “advice autopilot.”

The perils of “advice autopilot”

Advice autopilot is when you’re too lazy to think originally about a problem, instead regurgitate whatever smart thing you read on Quora or Hacker News. If you’re a bit more connected, instead you might parrot back what’s being spoken at during Silicon Valley events and boardrooms, yet the activity is still the same – everyone gets the same advice, regardless of situation. The problem is, the best advice rarely comes in this kind of format – instead, the advice will start out with “it depends…” and takes into account an infinite array of contextual and situational things that aren’t obvious. However, we are all lazy and so instead we go on autopilot, and do, read, say, and build, all the same things.

That’s not to say that sometimes generic advice isn’t good advice – sometimes it is, especially for noob teams who are working off an incomplete set of knowledge. Often you may not have the answers, but the questions can lead to interesting conversations. You may not be able to say “you should do an iPhone app” but it’s definitely useful to ask, “how does mobile fit into this?” This can help a lot.

The other manifestation of this advice autopilot is the dreaded use of “pattern matching” to recommend solutions and actions.

Pattern-matching in a world of low probability, exceptional outcomes

One of Silicon Valley’s biggest contradictions is the love of two diametrically opposed things:

- The use of pattern-recognition to predict the future…

- … and the obsession with a small number of exceptional successes.

Exceptional outcomes for startups are limited – let’s say it’s really only 5-10 companies per year. In this group, you’d include companies like Facebook and Google that have “made it” and hit $100B valuations. On the emerging side, this would include startups who might ultimately have a shot at this, like Dropbox, Square, Airbnb, Twitter, etc. This is an extraordinarily small set of companies, and it isn’t much data.

The problem is, we’re hairless apes that like to recognize patterns, even in random noise. So as a result, we make little rules for ourselves – Entrepreneurs who are Harvard dropouts are good, but dropping out of Stanford grad school is even better. It’s good if they start a company in their 20s unless they’re Jeff Bezos. Being an alum of Google is good, but being an alum of Paypal is even better. Hardcore engineers as founders is good, but the list of exceptions is long: Airbnb, Pinterest, Zynga, Fab, and many others. And whatever you do, don’t fund husband-wife teams, unless they start VMWare or Cisco, in which case forget that piece of advice.

As anyone who’s taken a little statistics knows, when you have a small dataset and lots of variables, you can’t predict shit. And yet we try!

The intense focus on a small set of companies also introduces a well-known logical fallacy called Survivorship Bias. Here’s the Wikipedia page, it’s interesting reading. Basically, the idea is that we draw our pattern-recognition from well-publicized successful companies while ignoring the negative data from companies that might have done many of the same things, but end up with unpublicized failures. We’re all so intimately familiar with stories like “two PhDs from Stanford start Google” that we ignore all the cases where two PhDs from Stanford try to start a company and fail. Or similarly, YCombinator has built a great rep on companies like Airbnb and Dropbox, and yet you’d think that if you invest in 600+ startups that you’d get a few hits. Because of factors like this, it might seem as though A predicts B when in fact, it does nothing of the sort – we’re just not taking the entire dataset into account.

Conformity leads to average outcomes when we seek exceptional outcomes

The problem with giving and taking so much of the same advice is that ultimately it breeds conformity, which is another way if saying it reduces the variance in the outcome. And if you conform enough, you end up creating the average outcome:

The average outcome for entrepreneurs is, your startup fails.

Lets not forget that. And so one part of Naval Ravikant’s talk on fundable startups that resonated with me is the idea of playing to your extremes. He says in the talk:

“Investors are trying to find the exceptional outcomes, so they are looking for something exceptional about the company. Instead of trying to do everything well (traction, team, product, social proof, pitch, etc), do one thing exceptional. As a startup you have to be exceptional in at least one regard.” –Naval Ravikant @naval

Be extremely good at something, and invest in it disproportionately relative to your competition – this gives you the opportunity to actually create an extreme outcome. Otherwise, the average outcome doesn’t seem so good.

The flipside of innovation

The funny thing with all of this, of course, is that this is what innovation looks like. The remarkable ability for practical knowledge to disseminate amongst the Bay Area tech community is what makes it so strong. Before something becomes autopilot advice for a wide variety of people, often a small number of hard-working teams who know what they’re doing leverage it to great success. Follow those people, and you might find yourself successful – just like them.

So the billion dollar question is – how do you separate out trendy/junk advice from what really matters?

… well, it depends!

Top tweets recently on startups, tech, and more

I recently dug through Favstar.fm and found a bunch of the tweets over the last few months that were saved/retweeted the most. Wanted to save them here for posterity:

Teardowns

- Facebook, Google, Twitter, eBay, YouTube, Wikipedia, Amazon, Hotmail, Blogger, Apple: How they used to look http://t.co/fL2zDHu0

- The Secret To Pinterest’s Astounding Success: A Brilliant Sign-Up Process You Should Copy http://t.co/AsGi9pBx

- Airbnb’s first pitch deck http://t.co/3BTSY6dO

- Android Gripes, Why do apps from the same company look worse on Android than on iPhone? http://bit.ly/h19EKL

- Why Angry Birds is so successful and popular: a cognitive teardown of the user experience http://bit.ly/dN3W3d

Compilations

- 11 Books Every Leader Should Read – Bob Sutton http://t.co/gwViu9DQ

- 5 Articles on Rapid Prototyping you Should Have Read – LaunchBit http://t.co/cF10LzKI

- Platforms and Networks: Managing Startups: Best Posts of 2011 http://t.co/mdeyv3wK

- 5 Former Design Trends That Aren’t Cool Anymore (So Stop Using Them) | Design Shack http://t.co/59prlt1N

Quotes

- “Success is like being pregnant: everybody congratulates you but nobody knows how many times you were fucked…” via @NatalieSEO

- “No matter how beautiful, no matter how cool your interface, it would be better if there were less of it.” –Alan Cooper (via @destraynor)

- Very appropriate for entrepreneurs: “A casual stroll through the lunatic asylum shows that faith does not prove anything.” -Nietzsche

- grid is the new feed, custom cover is the new custom background, real name is the new username, and repin/reblog is the new embed code.

- “The easiest way to get 1 million people paying is to get 1 billion people using” -Phil Libin, CEO Evernote http://bit.ly/f1SY7U

Media

- Steve Jobs – 25 years old, rare footage of him presenting about early Apple http://t.co/AiNbyW0S

- INFOGRAPHIC: How rich are the superrich? http://bit.ly/hxavXB

- INFOGRAPHIC: Carbs Are Killing You http://t.co/FMdZ5pEG

- Amazing PDF with lots of conversion %s to compare your product against http://bit.ly/e2t6Ip

Articles

- Bye Bye, Long Tail http://tcrn.ch/gfTOYP

- interesting lesson on listening to customer self-reporting: Walmart’s $1.85 billon dollar mistake – Daily Artifacts http://t.co/8GLLajdx

- Design is Horseshit! http://t.co/12vw2MZN

- If You’re Competing On Features You’ve Already Lost http://bit.ly/jbfk8p

- My answer on Quora to: What are the best metrics for measuring user engagement? http://qr.ae/OyAD

- i find myself explaining scalable startups vs smallbiz / lifestyle all the time. This blog breaks it down. Via @sgblank http://t.co/DJNSkTx

- Why Do Some People Learn Faster? | Wired Science | Wired.com http://t.co/Zd53Z3Bl

- The Top Ten Signs the Valley is on Tilt Again http://bit.ly/fjZUhk

Ask me anything!

Here’s the form as a link if you can’t see it – questions, thoughts, etc appreciated.

Why you’ll always think your product is shit

Lobby of the Pixar offices in Emeryville, CA

“My product isn’t quite there yet.”

You’ve said this before. We all have.

Anyone working on getting their first product out to market will often have the feeling that their product isn’t quite ready. Or even once it’s out and being used, nothing will seem as perfect as they could be, and if you only did X, Y, and Z, then it woould be a little better. In a functional case, this leads to a great roadmap of potential improvements, and in a dysfunctional case, it leads to unlaunched products that are endlessly iterated upon without a conclusion.

About a year ago I visited Pixar’s offices and learned a little about this product, and I wanted to share this small story below:

Over at Pixar…

Matt Silas (@matty8r), a long-time Pixar employee offered to take me on a tour of their offices and I accepted his gracious offer. After an hour-long drive from Palo Alto to Emeryville, Matt showed up while I was admiring a glass case full of Oscars, and started full tour. I didn’t take great photos, so here’s some better ones so you can see what it’s like: Venturebeat, Urbanpeak.

I’ve always been a huge fan of Pixar – not just their products, but also their process and culture. There’s a lot to say about Pixar and their utterly fascinating process for creating movies, and I’d hugely recommend this book: To Infinity and Beyond. It gave me a kick to know that Pixar uses some very collaborative and iterative methods for making their movies – after all, a lot of what they do is software. Here’s some quick examples:

- Pixar’s teams are ultimately a collaboration of creative people and software engineers. This is reflected at the very top by John Lasseter and Ed Catmull

- The process of coming up with a Pixar movie starts with the story – then the storyboard – then many other low-fidelity methods to prototype what they are ultimately make

- They have a daily “build” of their movies in progress so they know where they stand, with sketches and crappy CGI filling holes where needed – compare this to traditional moviemaking where it’s only at the end

- Sometimes, as with the original version of Toy Story, they have to stop doing what they’re doing and restart the entire moviemaking process since the whole thing isn’t clicking – sound familiar, right?

The other connection to the tech world is that Steve Jobs personally oversaw the design of their office space. Here’s a great little excerpt on this, from director Brad Bird (who directed The Incredibles):

“Then there’s our building. In the center, he created this big atrium area, which seems initially like a waste of space. The reason he did it was that everybody goes off and works in their individual areas. People who work on software code are here, people who animate are there, and people who do designs are over there. Steve put the mailboxes, the meetings rooms, the cafeteria, and, most insidiously and brilliantly, the bathrooms in the center—which initially drove us crazy—so that you run into everybody during the course of a day. [Jobs] realized that when people run into each other, when they make eye contact, things happen. So he made it impossible for you not to run into the rest of the company.”

Anyway, I heard a bunch of stories like this and more – and as expected, the tour was incredible, and near the end, we stopped at the Pixar gift shop.

There, I asked Matt a casual question that had an answer I remember well, a year later:

Me: “What’s your favorite Pixar movie?”

Matt: *SIGH*

Me: “Haha! Why the sigh?”

Matt: “This is such a tough question, because they are all good. And yet at the same time, it can be hard to watch one that you’ve worked on, because you spend so many hours on it. You know all the little choices you made, and all the shortcuts that were taken. And you remember the riskier things you could have tried but ended up not, because you couldn’t risk the schedule. And so when you are watching the movie, you can see all the flaws, and it isn’t until you see the faces of your friends and family that you start to forget them.”

Wow! So profound.

A company like Pixar, who undoubtedly produces some of the most beloved and polished experiences in the world, ultimately still cannot produce an outcome where everyone on the team thinks it is the best. And after thinking about why, the reason is obvious and simple – to have the foresight and the skill to refine something to the point of making it great also requires the ability to be hugely critical. More critical, I think, than your ability to even improve or resolve the design problems fast enough. And because design all comes to making a whole series of tradeoffs, ultimately you don’t end up having what you want.

The lesson: You’ll always be unhappy

What I took away from this conversation is that many of us working to make our products great will never be satisfied. A great man once said, your product is shit – and maybe you will always think it is. Yet at the same time, it is our creative struggle with what we do that ultimately makes our creations better and better. And one day, even if you still think your product stinks, you’ll watch a customer use it and become delighted.

And for a brief moment, you’ll forget what it is that you were unhappy about.

Special thanks to Matt Silas (@matty8r, follow him!) for giving me a unique experience at Pixar. (Finally, I leave you with a photo of me posing next to Luxo Jr.)

Linkedin acquires Connected – congrats to my sister Ada!

Quick blog post to congratulate my sister Ada Chen and her husband Sachin Rekhi, who have just announced the acquisition of their startup Connected to LinkedIn. The company was backed by a seed investment from Ignition Partners and Trinity Ventures.

Here’s an excerpt from AllThingsD:

LinkedIn has acquired Connected, a small contact management startups that unifies and dynamically updates users’ connections on email, social networks, calendars and phones, according to sources close to the company.

Connected is similar to Xobni/Smartr, but it’s more of a dashboard than a plug-in, and it costs $9.99 per month. The company had raised a seed round of $500,000 led by Trinity Ventures in June. The service has been called “bloody awesome” by Tim O’Reilly.

Ada and Sachin posted some additional info via blog post with the annoucement. They’ll soon be moving down to Mountain View as part of the purchase so I’ll get to see them more often!

20+ pitches from the new 500Startups cos

Yesterday I attended the 500Startups demo day – it was a fun event and will be interesting to compare to the YC demo day coming up later this month as well.

For everyone who didn’t make it, I wanted to share all the slides:

Don’t compete on features

The “Ultimate Driving Machine” is a classic slogan that makes BMW compete based on position, not features.

It’s hard to keep things simple, especially when adding so many new features

In my recent post on the virtues of marketing simple products, a couple readers wrote in to write a really interesting questions – here’s a particularly interesting one by Mark Hull:

How do you ensure that by simplifying your product too much, you are not losing a competitive edge by a lack of additional features/functions?

Every product team struggles with this question- it seems like naturally adding more featureset adds more power to the product, yet at the same time adds complexity that makes it hard for new users to even get started. This is a common problem in the initial version of a product, because most of the time the first version doesn’t work, and the most obvious way to solve the problem is to just keep adding features until it starts to click. Yet does this ever work?

Don’t compete on features. If your core concept isn’t working, rework the description of the product rather than adding new stuff.

Make sure you’re creating a product that competes because it’s taking a fundamentally different position in the market. If the market is full of complex, enterprise tools, then make a simpler product aimed at individuals. If the market is made up of fancy, high-end wines, then create one that’s cheaper, younger, and more casual. If the market is full of long-form text blogging tools, then make one that makes it easy to communicate in 140 character bursts. If computers are techy and cheap, then make one that’s human and more premium. These ideas are not about features, these are fundamentally different positions in the market.

BMW is the Ultimate Driving Machine

My favorite example of differentiated market positioning in a very crowded market is BMW’s “Ultimate Driving Machine” slogan. It’s not just a marketing message, you know it’s true when you sit inside a BMW and turn on the engine. Among other things, you’ll notice that:

- The center console is aimed towards you, the driver

- The window controls are next to your stick so it’s easier for your right hand*

- … and obviously the remarkable driving experience

Furthermore, when you go to the dealership, the entire experience keeps reinforcing the “Ultimate Driving Machine” message. The point is, the positioning is about the driving experience and the engineering to back that up.

In a price and features comparison, it’s unlikely that BMW would ever come on top- it’s expensive, and very little of the money goes into the interior and niceties that you’d expect out of a Mercedes. Yet people end up buying BMWs not for the features, but because it’s a fundamentally different car than a Mercedes (or at least it feels that way).

I’ve always felt that Apple goes this way too, where their products are more expensive and often do a lot less than competitive devices, yet win because they have a more cohesive design intention across their whole UX. Again, the idea here is more about competing via a differentiated positioning rather than based on a feature checklist.

You’ll never win on features against a market leader

The other important part to remember is that for the most part, if there’s a winning product X on the market, you’re unlikely to win by creating the entire featureset of X+1 by adding more features. Here’s why:

- First off, that’s crazy because you have to build a fully featured product right away, and that might already take years to match a market leader

- Secondly, as described in the Innovator’s Dilemma, if you’re mostly copying the market leader and then adding features, those features are likely to be sustaining innovations that is likely on the incumbents roadmap already- by the time you’re done, they’ll either have it or just copy you

Instead, the idea is to have a simpler product that attacks the low-end of the market leader’s product by taking a completely different market positioning. That way, you don’t have to build a fully featured product and you can take a completely different design intention, which leads to a disruptive innovation.

Ramifications for startups building initial versions of a product

I think there are three key ramifications for teams building the first version of a product.

The first is: Don’t compete on features. Find an interesting way to position yourself differently – not better, just differently – than your competitors and build a small featureset that addresses that use case well. Then once you get a toehold in the market, you can figure out what to do there. This doesn’t mean that new features are inherently bad, of course- they are fine, as long as they support the differentiation that you’re promising.

The second thing is: If your product initially doesn’t find a fit in the market (as is common), don’t react by adding additional new features to “fix” the problem. That rarely works. Instead, rethink how you’re describing the product and how you deliver differentiated value in the first 30 seconds. Rework the core of the experience and build a roadmap of new features that reflects the differentiated positioning. Avoid add-ons.

The third is: Make sure your product reflects the market positioning- this isn’t just marketing you know! If your product is called the Ultimate Driving Machine, don’t just slap that onto your ads and call it a day. Instead, bring that positioning into the core of your product so that it’s immediately obvious to anyone using it- it’s only in that way your product will be fundamentally differentiated from the start.

* UPDATE: An astute reader, Greg Eoyang, pointed out that the modern generation BMWs (E90s) are different now- I have an E46 that’s a few years old, so I was basing my observation on that. He writes:

First of all, a most modern BMWs do not have the window controls near the stick, that’s like 2 generations old, they are on the windows just like Honda’s these days. BMW doesn’t even tell you about a lot of the features that have been standard for a long time – such as speed variable volume on the radios – Wide Open Throttle switch (back in the non-CPU days, it cut off the air conditioner when you floored it) – They have improved the concept of a car which is more than the features.

Thanks for the additions Greg!

Quora: What UX considerations were built into Google+?

This is reposted from my answer on Quora here.

Question: What UX considerations were built into Google+?

The most interesting design choice I’ve seen for G+ has been deploying it across all the Google properties within a navbar, and via the notifications – I’m talking about this thing right here:

![]()

(btw, looking at it now, I notice it’s the same coloring scheme as Quora, hilarious)

Building G+ on top of pre-existing, high-retention products

Obviously this is a smart decision because it lets them build on top of their own high-retention, pre-existing products: Google Search and Gmail, in particular. Contrast this to an approach where they would have started up G+ as its own independent property, which Google users could choose to adopt or not- but then that looks like Orkut.

Anyway, as a result of adding this new global navbar across all the Google properties, they have to deal with a very small amount of real estate to create some pretty rich interactions. Thus, it was very interesting to then see them building a mobile-like interface for interacting with comments, follows, etc., inline, without leaving whatever experience you’re already in:

And if you click on any of these, you see a quick sliding motion that lets you interact with the different notifications inline, without going anywhere:

Contrasting with Facebook