Archive for the ‘Uncategorized’ Category

New data shows losing 80% of mobile users is normal, and why the best apps do better

Exclusive data on retention curves for mobile apps

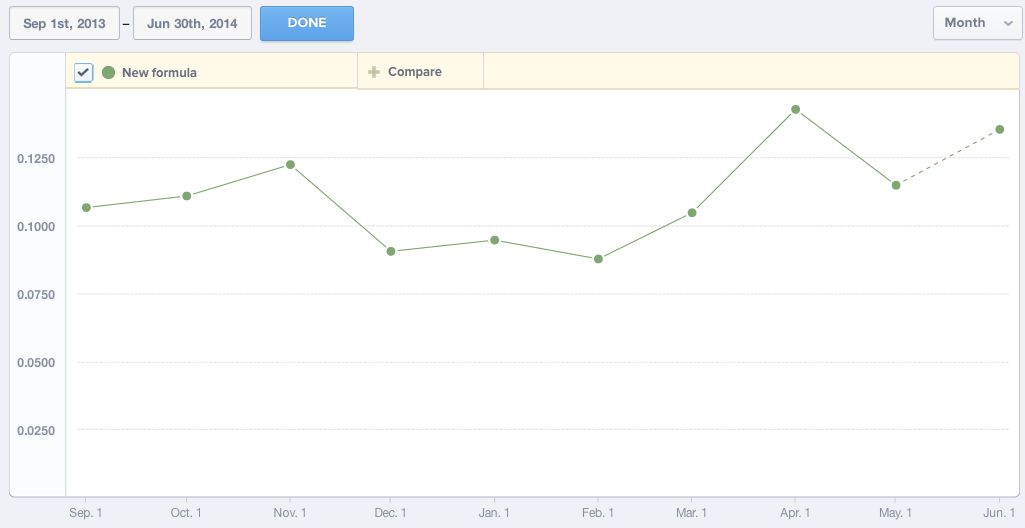

In a recent essay covering the Next Feature Fallacy, I explained why shipping “just one more feature” doesn’t fix your product. The root cause is that the average app has pretty bad retention metrics. Today, I’m excited to share some real numbers on mobile retention. I’ve worked with mobile intelligence startup Quettra and it’s founder/CEO Ankit Jain (formerly head of search+discovery for Google Play) to put together some exclusive data/graphs on retention rates** based on anonymized datapoints from over 125M mobile phones.

Average retention for Google Play apps

The first graph shows a retention curve: The number of days that have passed since the initial install, and what % of those users are active on that particular day. As my readers know, this is often used in a sentence like “the D7 retention is 40%” meaning that seven days after the initial install, 40% of those users was active on that specific day.

The graph is pretty amazing to see:

Based on Quettra’s data, we can see that the average app loses 77% of its DAUs within the first 3 days after the install. Within 30 days, it’s lost 90% of DAUs. Within 90 days, it’s over 95%. Stunning. The other way to say this is that the average app mostly loses its entire userbase within a few months, which is why of the >1.5 million apps in the Google Play store, only a few thousand sustain meaningful traffic. (*Tabular data in the footnotes if you’re interested)

Ankit Jain, who collaborated with me on this essay, commented on this trend:

Users try out a lot of apps but decide which ones they want to ‘stop using’ within the first 3-7 days. For ‘decent’ apps, the majority of users retained for 7 days stick around much longer. The key to success is to get the users hooked during that critical first 3-7 day period.

This maps to my own experience, where I see that most of the leverage in improving these retention curves happen in how the product is described, the onboarding flow, and what triggers you set up to drive ongoing retention. This work is generally focused on the first days of usage, whereas the long-term numbers are hard to budge, no matter how many reminder emails you send.

Note that when we say that these DAUs are being “lost” it doesn’t mean that users are suddenly going completely inactive – they might just be using the app once per week, or a few times per month. Different apps have different usage patterns, as I’ve written about in What factors influence DAU/MAU? with data from Flurry. Just because you lose a Daily Active User doesn’t mean that you’re losing a Monthly Active User, yet because the two correlate, you can’t sustain the latter without the former.

Get new updates, usually once a week – featuring long-form essays with what’s going on in tech.

How do the best apps perform? Much better.

The second graph we’ll discuss is a comparison of retention curves based on Google Play ranking. The data shows that there is a very clear and direct correlation:

The top apps have higher D1 retention rates, and end with much stronger absolute D30 numbers. However, interestingly enough, the falloff from D1 to D30 is about the same as all the other apps. Another way to say it is that users find the top apps immediately useful, use it repeatedly in the first week, and the drop off happens at about the same speed as the average apps. Fascinating.

Bending the curve happens via activation, not notification spam

To me, this is further validation that the best way to bend the retention curve is to target the first few days of usage, and in particular the first visit. That way, users set up themselves up for success. Although the data shown today relates to mobile apps, I’ve seen data for desktop clients and websites, and they all look the same. So whether you’re building a mobile app or something else, the same idea applies:

- For a blogging product, you might want users to pick a theme, a name, and write their first post, to get them invested.

- For a social service, you might want users to import their addressbook and connect to a few friends, to give them a strong feed experience and opt them into friend notifications

- For a SaaS analytics product, you might want users to put their JS tag on their site, so that you can start collecting data for them and sending digest emails

- For an enterprise collaboration product, you might want users to start up a new project and add a couple coworkers to get them started

Each of the scenarios above can have both a qualitative activation goal, as well as quantitive results to make sure it’s really happening. Whatever you do, sending a shitload of spammy email notifications with the subject line “We Miss You” is unlikely to bend the curve significantly.

I hate those, and you should too.

(Thanks again to Ankit Jain of Quettra for sharing this data and assisting me in developing this piece. More from them here, which examines app-by-app retention rates for messaging apps)

*Tabular data

| 0 | 1 | 3 | 7 | 14 | 30 | 60 | 90 | |

| Top 10 Apps | 100 | 74.67 | 71.51 | 67.39 | 63.28 | 59.80 | 55.10 | 50.87 |

| Next 50 Apps | 100 | 64.85 | 60.31 | 54.13 | 49.48 | 44.81 | 39.60 | 34.50 |

| Next 100 Apps | 100 | 48.72 | 42.96 | 35.93 | 30.79 | 25.45 | 21.25 | 18.98 |

| Next 5000 Apps | 100 | 34.31 | 28.54 | 21.64 | 17.43 | 13.62 | 10.74 | 8.99 |

| Average | 100 | 29.17 | 23.42 | 17.28 | 13.11 | 9.55 | 6.82 | 3.97 |

**Methodology

Some notes on methodology below, shared by Quettra:

Quettra software, that currently resides on over 125M Android devices worldwide, collects install and usage statistics of every application present on the device. For this report, we examine five months of data starting from January 1, 2015.

Since we exclusively consider Android users in this study, we exclude Google apps (e.g. Gmail, YouTube, Maps, Hangouts, Google Play etc.) and other commonly pre-installed apps from our study to remove biases. We also only consider apps that have over 10,000 installs worldwide.

A note on privacy, which is very important to us: All data that we collected is anonymized, and no personally identifiable information is collected by any of our systems. From our understanding, this is the first time ubiquitous mobile application usage has been analyzed at such large scale. Quettra does not have a direct relationship with any of the apps or app developers mentioned in this report.

Photos of the women who programmed the ENIAC, wrote the code for Apollo 11, and designed the Mac

Ada Lovelace, an early computing pioneer, featured prominently in Walter Isaacson’s book The Innovators

Innovation is messy, and too easy to oversimplify

After finishing Walter Isaacson’s biography of Steve Jobs, I eagerly devoured his followup book, The Innovators. This book zooms out to focus not on an individual, but on the teams of collaborators and competitors who’ve driven technology forward, and the messiness of innovation. The stars of the story turn out to be the often unappreciated women who contributed to computing at key moments, and the book fittingly begins and ends with Ada Lovelace, an 19th century mathematician who defined the first algorithm and loops. I recommend the book, and here are the NYT and NPR write-ups which you can check out as well.

Isaacson’s book resonated with me because once you know how messy the success stories are, it’s obvious why the media always chooses to simplify things down to just a few characters with simple motivations. As a result, we know what kind of shoes that Steve Jobs wears, but forget the names of the people around him who worked for years to make the products we love.

The stories from the book have been floating around in my brain for a few months now, and coincided with two other pieces that went viral on Twitter/Facebook. First, there’s been some great photos of Margaret Hamilton who led the software development for Apollo 11 mission. Second, there was a discussion on Charlie Rose on the women who worked on the original Macintosh. I did some research and put together a few photos of these key pioneers from computing history. Seeing their faces and names help make them more real, and I wanted to share the photos along with some blurbs for context.

If you have more photos to send me, just tweet them at @andrewchen and I’ll continue to update this article.

Women of ENIAC

One of the most interesting backstories in Isaacson’s book is the fact that women mostly dominated software in the early years of computing. Programming seemed close to typing or clerical work, and so it was mostly driven by women:

Bartik was one of six female mathematicians who created programs for one of the world’s first fully electronic general-purpose computers. Isaacson says the men didn’t think it was an important job.

“Men were interested in building, the hardware,” says Isaacson, “doing the circuits, figuring out the machinery. And women were very good mathematicians back then.”

In the earliest days of computing, the US Army built the ENIAC, the first electronic general purpose computer in 1946. And women programmed it – but not the way we do now – it was driven by connecting electrical wires and using punch cards for data.

Left: Patsy Simmers, holding ENIAC board Next: Mrs. Gail Taylor, holding EDVAC board Next: Mrs. Milly Beck, holding ORDVAC board Right: Mrs. Norma Stec, holding BRLESC I board.

Left: Betty Jennings. Right: Frances Bilas

Jean Jennings (left), Marlyn Wescoff (center), and Ruth Lichterman program ENIAC at the University of Pennsylvania, circa 1946.

Margaret Hamilton and Apollo 11

Twitter has been circulating this amazing photo of Margaret Hamilton and printouts of the Apollo Guidance Computer source code. This is the code that was used in the Apollo 11 mission, you know, the one that took humankind to the moon. This is how Margaret describes it:

In this picture, I am standing next to listings of the actual Apollo Guidance Computer (AGC) source code. To clarify, there are no other kinds of printouts, like debugging printouts, or logs, or what have you, in the picture.

There are some nice articles about this photo on both Vox and Medium, which are worth reading.

Here it is, along with a few other photos of her during this time:

A side note to this that I found pretty nerdtastic is that the the guidance computer used something called “core rope memory” which was weaved together by an army of “little old ladies” in order to resist the harsh environment of space.

To resist the harsh rigors of space, NASA used something called core rope memory in the Apollo and Gemini missions of the 1960s and 70s. The memory consisted of ferrite cores connected together by wire. The cores were used as transformers, and acted as either a binary one or zero. The software was created by weaving together sequences of one and zero cores by hand. According to the documentary Moon Machines, engineers at the time nicknamed it LOL memory, an acronym for “little old lady,” after the women on the factory floor that wove the memory together.

Here’s what it looked like:

Susan Kare, Joanna Hoffman and the Mac

Megan Smith, the new chief technology officer of the United States, was on Charlie Rose recently and referenced the fact that the women who worked on the Macintosh were unfairly written out of the Steve Jobs movie – you can see the video excerpt of her speaking about it here. I tracked down the photo she was referring to, and wanted to share it below.

Macintosh team members: Row 1 (top): Rony Sebok, Susan Kare; Row 2: Andy Hertzfeld, Bill Atkinson, Owen Densmore; Row 3: Jerome Coonen, Bruce Horn, Steve Capps, Larry Kenyon; Row 4: Donn Denman, Tracy Kenyon, Patti Kenyon

On the top of the pyramid photo is Susan Kare, who was a designer on the original Mac and did all the typefaces and icons. Some of the most famous visuals, such as the happy mac, watch, etc., are all from her.

![]()

One cool thing to add to your office: Some signed/numbered prints of Susan’s most famous work. I have a couple – here’s the link to get your own.

Here’s a May 2014 talk. Susan Kare, Iconographer (EG8) from EG Conference on Vimeo.

Another key member of the original Mac team, Joanna Hoffman, isn’t in the pyramid photo but I was able to find a video of her talking about the Mac on YouTube, and embedded it below. Here’s the link if you can’t see the embed. She wasn’t in the Steve Jobs movie from Ashton Kutcher, but it looks like she will be played by Kate Winslet in the new Aaron Sorkin film coming out.

Here’s the video:

Bonus graph: Women majoring in Computer Science

Hope you enjoyed the photos. If you have more links/photos to include, please send them to me at @andrewchen.

As a final note, one of the most surprising facts from Isaacson’s book is that early computing had a high level of participation from women, but dropped off over time. I was curious when/why this happened, and later found an interesting article from NPR which includes a graph visualizing the % of computer science majors who are women over the last few decades.

The graph below is from the NPR article called When Women Stopped Coding – it’s worth reading. It speculates that women stopped majoring in Computer Science around the time that computers hit the home, in the early 80s. That’s when male college students often showed up with years of experience working with computers, and intro classes came with much higher expectations on experience with computers.

The Next Feature Fallacy: The fallacy that the next new feature will suddenly make people use your product

A few weeks ago, I read this tweet, and found myself nodding my head in vigorous agreement.

The Next Feature Fallacy: the fallacy that the next feature you add will suddenly make people want to use the entire product.

— Joshua Porter (@bokardo) May 14, 2015

For people who love to build product, when something’s not working, it’s tempting to simply build more product. It leads to the launch-fail-relaunch cycle that I alluded to in a previous essay, Mobile app startups are failing like it’s 1999. However, this rarely works, and when you look at the metrics, it’s obvious why.

The metrics behind the Next Feature Fallacy

Let’s go into the numbers. The reason why the Fallacy is true can be described by one simple diagram, which might be described as the most tragic curve in tech:

The above diagram shows the precipitous drop-off between initially attracting a user versus the difficulty of retaining them over the first month. Perhaps it reminds you of the diagram, popularized by Edward Tufte, of the destruction of the Napoleon’s Grande Armée during his disastrous invasion of Russia. The curve drops off fast- very fast. I’ve seen a lot of real data around this, and believe me, there are very few cases where things look pretty.

Some example metrics for a web app with average (but not great) numbers:

- 1000 users visit your homepage to check out your product

- 20% sign up

- 80% finish onboarding

- 40% visit the next day after signup

- 20% visit the next week after signup

- 10% visit after 30 days after signup

- After 30 days, 20 users (out of 1000!) are DAUs

This is pretty typical, and you can see the steep drop-off.

And yes, occasionally I’ve seen better numbers than this, for apps that have built a great brand, or are getting most of their traffic through high-conversion referrals. Or the D1/D7/D30 for certain categories, like messaging apps, are often 2-3X higher than what I’m publishing above. But in the main, everyone is a bit depressed about their numbers. I’ve written about the routine mediocrity of these metrics in more detail here: Why consumer product metrics are all terrible.

The vast majority of features won’t bend the curve

These metrics are terrible, and the Next Feature Fallacy strikes because it’s easy to build new features that don’t target the important parts. Two mistakes are often made when designing features meant to bend this engagement curve:

- Too few people will use the feature. In particular, that the features target engaged/retained users rather than non-users and new users

- Too little impact is made when they do engage. Especially the case when important/key functions are displayed like optional actions outside of the onboarding process.

These mistakes are made because there’s often the well-intentioned instinct to focus on features that drive deep engagement. Of course you need a strong baseline of engagement, but at its extreme, this turns misguided because features that aren’t often used can’t bend the curve. A “day 7 feature” will automatically be used less than an experience tied to onboarding, since the tragic curve above shows that fewer than 4% of visitors will end up seeing it.

Similarly, a product’s onboarding experience can be weak if there isn’t a strong opinion on the right way to use (and setup) the product. In the early Twitter days, you’d sign up and immediately be dropped onto a blank feed, and a text box to type in your status. While this might let you explore the product and do anything, ultimately this is a weaker design then asking you to follow a bunch of accounts, which is the current design. Understanding that Twitter is meant to be mostly used as a reader, potentially without tweeting much, is a deep insight and a strong opinion that has paid dividends for the product.

Another frame to think about is to make sure a new feature doesn’t assume deep engagement/investment in your product. Let’s introduce the concept of an engagement wall, which exists at the moment that your product asks the user to deeply invest in their product usage, where “behind the wall” means that the feature can only be experienced once the users buys into a product, and engages. An example might be a high-effort, low % action like posting a photo, creating a new project, or dropping files into a folder. In front of the wall means features that create value without much investment, such as browsing a feed, rating some photos, or clicking a link. If you build a bunch of amazing features that are behind the engagement wall, then chances are, only a small % of users will experience the benefits. Adding a bunch of these features won’t bend the curve.

How to pick the next feature

Picking the features that bend the curve requires a strong understanding of your user lifecycle.

First and foremost is maximizing the reach of your feature, so it impacts the most people. It’s a good rule of thumb that the best features often focus mostly on non-users and casual users, with the reason that there’s simply many more of them. A small increase in the front of the tragic curve can ripple down benefits to the rest of it. This means the landing page, onboarding sequence, and the initial out-of-box product experience are critical, and usually don’t get enough attention.

Similarly, it’s important to have deep insights on what users need to do to become activated, so that their first visit is set up properly. For social networks, getting them to follow/add friends is key, because that kicks off a number of loops that will bring them back later on. For a SaaS metrics app, it might be getting a JS tag onto the right pages. For a blog, it might be for them to pick a name, theme, and write the first post so they get invested. Isolating the minimum onboarding process lets you keep the initial steps high-conversion, yet set up their experience for success.

When a product is still early, when you’re searching for and building game-changing features, the resources those features eat through can be massive. The risk that your company takes in building them might be too high, and your team might overestimate the probability that a feature will meet your expected growth goals for it. There is always a chance that the next feature will bend the curve, but it requires being smart, shrewd, and informed. Good luck.

Why investors don’t fund dating

I’ve been listening to the excellent Season 2 of the podcast Startup, which gives an inside look at YCombinator startup The Dating Ring (NYT coverage here). The episodes are all great. They talk about many important topics, but I had some specific comments on fundraising for dating products.

Here’s a simple fact: It’s super hard to get a dating product funded by mainstream Silicon Valley investors, even though it’s a favorite startup category from 20-something entrepreneurs. There’s a large swath of angels/funds who categorically refuse to invest in the dating category in the same way that many refuse to invest in games, hardware, gambling, etc. Perhaps they’d make an exception for a breakout like CoffeeMeetsBagel (I’m an advisor) or Tinder, but in the main, it’s an uphill battle for dating apps to attract interest. Here’s some data on the few dating cos that have raised.

Obviously, anyone starting a new company in dating should try to understand investor biases in this sector. This essay also compliments a previous one on operating, from HowAboutWe co-founder Aaron Schildkrout, now at Uber, who also wrote about his experiences.

Here are the reasons usually given for why investors don’t do dating:

- Built-in churn

- Dating has a shelf-life

- Paid acquisition channels are expensive

- City-by-city expansion sucks

- Hard to exit

- Demographic mismatch with investors

Let’s break it down.

Built-in churn

Churn sucks, and the better your dating product works, the more your customers will churn*. Every churned customer is a new customer you’ll have to acquire just to get back to even. When you look at a successful subscription service like Netflix or Hulu, you might find a churn rate of 2-5% per month, and you can calculate the annual churn through the following:

Annual Churn = 1-(1-churn_rate)^12

2% monthly churn = 1-(1-0.02)^12 = 21% annual churn

10% monthly churn = 1-(1-0.1)^12 = 70% annual churn

If you have an 70% annual churn rate, you have to have a strategy to replace almost your entire customer base each year, plus a bunch of percentage points to drive topline growth. You can imagine why successful public SaaS companies try to keep their monthly churn under 2%.

So what do the churn rates look like for a dating product? I’ve heard numbers as high as 20-30% monthly. Let’s calculate that:

20% monthly churn = 1-(1-0.2)^12 = 93% annual churn

You read that right. And that means at 20% monthly churn, it gets very hard to retain what you have, much less fill the top-of-funnel with enough new customers to grow the business. Scary.

With most subscription products, the more you improve your product, the lower your churn. With dating products, the better you are at delivering dates and matches, the more they churn! As you might imagine, that creates the wrong incentives. A product focused on casual dating, like Tinder, might escape this dilemma, but dating products generally have built-in churn that’s unavoidable.

Dating is niche and has a shelf-life

All this churn is especially complicated by the fact that the dating market at any given time is pretty niche. Similar to buying a car, refinancing your student loans, or moving into a new house, the reality is that being “in the market” as a single person looking to meet others has a limited time window. Another way to say this is the dating has “intent” the same way that shopping might, especially when you are talking about a paid subscription service. This limits the market size as well as restricting the types of marketing channels you can use to read those consumers.

A similar challenge is that these products aren’t “social” in the same way that Skype or Facebook might be. Although the stigma is quickly passing, it’s not like consumers want to sign up for a dating site and then invite their friends+family to join them on the site. In that way, it’s more similar to a financial or health product, where some privacy is required.

Again, one of the ways that the new generation of mobile dating products solve this is that they are free plus focus more on casual dating. Both factors open up the market to a wider audience, reduce churn, and create opportunities for viral growth.

Paid acquisition channels are expensive

Dating products have historically depended on paid acquisition channels to build their customer base, and other subscription products have generally done the same. In order to make the ROI work, you have to calculate your customer acquisition cost (CAC) versus your lifetime value (LTV) and make sure you are making enough money to support both the marketing as well as operations. In SaaS, you’d try to get a 3X ratio for CAC:LTV but that’s building in some profit for the company – a dating startup might be able to run it closer to the metal to get their initial growth.

Here’s a couple scenarios for products that buy their customers:

- Make a ton of money all at once (example: car/insurance/loan/mortgage leadgen)

- Make a little bit of money over a long period of time (storage, streaming music, etc.)

- Make a little money at first, then grow the revenue over a long period of time (SaaS)

Here’s a visualization of this:

When you start to fill in this chart, you can see a couple things:

First, you’ll observe that of course the “ideal” case might look like a super low churn business that also generates a ton of revenue from each customer. However, the market size might be much smaller than the others. Christoph Janz, a venture capitalist and initial investor in Zendesk wrote a great essay on this topic, called Five ways to build a $100M business that talks about market size as an issue for this.

But back to dating- where does it go? The trouble is, it has some of the same economics for consumer subscription products priced at <$50/month, but at the same time, super high churn that looks like a one-time product. It’s hard to build a high LTV off of that, and so paid channels turn tricky.

Again, this is an area where the new mobile dating apps excel. They have the ability to tap into organic viral/word-of-mouth installs, are super sticky due to their messaging features, and free installs mean infinity return on ad spend (ROAS). At the same time, their focus on casual dating lowers churn and they can monetize via microtransactions. It’s a different model that’s more attractive.

City-by-city expansion sucks

Dating products inherently rely on a local marketplace, and bootstrapping a series of marketplaces is very hard, and expensive. People are willing to travel to meet each other, but only so much. And there needs to be the right mix of male/female participants (or whatever permutation makes sense). To make this work, each city needs to get spun up the same way that on-demand services are spun up, which is one of the reasons why local expansion has remained expensive and unscalable.

This is why we often see dating products continually hold a series of unscalable events/parties/etc in a city to get things going. Until there’s word-of-mouth, and enough people to generate a quality experience, the marketplace will suck. But it’s slow going.

Demographic mismatch with older, married investors

Dating solves a problem that’s most universal and acute for unmarried 18-35yos. Most investors who can write checks (as opposed to associates) are older, married, with kids. Oftentimes they haven’t had to date anyone in decades, unless you’re talking about Ashley Madison. Given this demographic mismatch, it’s a lot harder to get investors to put in the time to really understand the nuances of how one dating product is superior to another. This isn’t just a problem for dating, but also for women’s fashion or startups targeting international markets. It’s tricky, and investors would often rather sit back and wait for traction rather than investing on the merits of a product, something they’re willing to do in other categories. (Thanks to my friend Jason Crawford for adding this point)

Hard to exit

In the end, we’ve seen that dating products often end up being owned by IAC. They own Match, OKCupid, Tinder, HowAboutWe, and others. They have deep experience in local and dating, and the deep pockets to squeeze profit from the category. In contrast, we’ve seen recent dating cos like Zoosk withdraw their IPO plans. I don’t have any inside info, but I’m sure it’s because the churn was high, the channels were degraded, and it was hard to replace lost customers.

In the end, the lack of exits might be more the result, not the cause, of investor disinterest in dating. After all, given the challenges above, it’s very hard to maintain a steady customer base much less grow it consistently year-after-year.

A final note on this: Investor pattern-matching is lazy and often sucks. Google wasn’t the 1st search engine and it wasn’t clear the category was a good investment. Lots of failures. Same with Facebook or Whatsapp. But the investors who won were able to look at the specific characteristics of some of these new companies, rather than looking at the category, and bet that they’d figure it out. Very possible within dating as well, and I wish everyone who’s working in the category that they will be the ones to figure it out.

UPDATE: Fixed some math, thanks Hacker News commenters.

Why we should aim to build a forever company, not just a unicorn

“Unicorn company.” It’s the latest bit of jargon that’s infected our conversations here in the Bay Area, to the point where both WSJ and Fortune have clever infographics and lists of the top companies. In pitches, entrepreneurs are asked to explain how their new company will become the next unicorn startup, and the tech press routinely debates if a hot new team will build the next unicorn. And yet, this term could not be a more meaningless goal for entrepreneurs.

After all, what’s the definition of a unicorn startup? Just one that reaches $1B in valuation? Who cares? I wish we’d just go back to saying “billion dollar startup” rather than unicorn, to reflect the real nature of the term, not one with a cutesy veneer.

It’s the ultimate vanity metric, because $1B of shareholder value is merely the lagging indicator that we’ve created something useful for the world. This should never, in itself, be the goal of starting up a company. So let’s all stop talking about unicorns. I’m calling peak unicorn. Let’s focus on the inputs for building impactful, lasting companies, where wealth creation is a side effect of doing a great job.

Instead, let’s talk about how to build our forever companies.

Low-attention spans in tech

When I first started out, as a young techie with a low attention-span living in Seattle, I had an irrational admiration for self-described “serial entrepreneurs,” the ones who build and sell a bunch of startups in their careers, even when they are quick flips. The variety of starting up multiple companies seems dreadfully exciting, especially when you are young and lack purpose. However, the more time I spend in the industry, the more my admiration shifts to those who start and run their companies for years, decades, and perhaps their whole lifetimes. Warren Buffett, Richard Branson, Jeff Bezos, Mark Zuckerberg, and others all fall into this camp.

These folks have started and built their forever companies. These companies also happen to be incredibly successful, but more importantly, as entrepreneurs they’ve found their life’s work.

After all, many of us in tech idolize Steve Jobs for his sense for design, and his vision. Some even emulate his fashion. But you know what’s hard to emulate? The fact that he started working on hardware/software products as a teenager, and built on those ideas for the next 40 years of his life, until he ran out of time. How many of us can profess a lifetime of dedication towards our work like that?

Counterbalance

The forever company is an entrepreneur-focused counterbalance to the financially-motivated goal of becoming a unicorn. Hopefully we can build both! Of course we all want our companies to be valuable, and make a big impact, but while a unicorn concerns itself with the output of entrepreneurship, the goal of a forever company starts with the inputs and the right intentions.

This is different than a lifestyle company. Bezos runs Amazon as his forever company, but it’s certainly not just to support his lifestyle, it’s to make a much bigger impact than that. And Amazon took millions in venture capital money on their way to becoming a public company, to fully capture the opportunity. There’s a different kind of problem when the desire for a lifestyle interferes with the “forever” part of the goal. Those who underinvest in their products create the danger for a smarter/bigger/funded competitor to put them out of business, which is a lifestyle company that doesn’t last forever! This distinction is subtle, but important.

I didn’t coin the term. It’s the kind of idea that could only come out of a deep, late-night conversation with my sister and bro-in-law Ada and Sachin, who also work in tech. They mentioned it in passing as a worth goal for themselves, one day, and the term really resonated with me. It’s stuck like few things have, and I hope it sticks with all my readers too.

When forever companies scale, and when they don’t

Sometimes forever companies scale and become a multi-billion dollar company. In many cases, a forever company and a unicorn are the same, when the market is big, the team is talented, and there’s some good luck. These are the companies we all want to start and want to fund in Silicon Valley. These companies are easy to embrace.

But sometimes, a forever company just implies a lifetime of dedication towards something that may never get big. There is great honor in that as well, and I can’t help but admire those who pursue this goal. By now, we’ve all seen Jiro Dreams of Sushi, and his passion and skill for sushi is incredible. Closer to tech might be someone like David Kelley of IDEO, who founded his firm decades ago, and while they’ll never be a unicorn, I imagine he must be very proud of the work they’ve done over the past 25+ years.

Finally, I want to leave you with a great interview with Jiro I saw recently. He talks about feeling like a master only after reaching 50 years. The discussion on handmade versus automation fascinating, as well as the work ethic of younger generations. Everyone who’s working in design or engineering in software will relate, I’m sure.

I’ve embedded it below but if it doesn’t show, here’s the link to Vimeo. Enjoy.

Ten classic books that define tech

Today, I was asked for the definitive list of books that I’d recommend as the classics for tech products and business. It’s hard to pare things down to such a short list, since there’s so much great stuff that’s been written.

In addition, a lot of new exciting books have been published in recent years, but they haven’t stood the test of time. My lists solely consists of books that skew oldish, but have aged well and continue to provide value today. This leaves out amazing contributions such as The Hard Thing About Hard Things, Zero to One, and The Lean Startup, which will undoubtedly make a list like this in future years.

With that in mind, here’s my list. I’m sure you’ve read many of them, but hopefully you find a gem or two that you haven’t already read. In no particular order:

- Crossing the Chasm

- The Inmates are Running the Asylum

- The Mythical Man Month

- Designing Interactions

- The Design of Everyday Things

- Founders at Work

- Innovator’s Dilemma

- High Output Management

- My Life in Advertising

- Four Steps to the Epiphany

- Bonus 11th book :) Different: Escaping the Competitive Herd

There’s also a number of great books that just tell the narrative of one company, such as The New New Thing, Startup, eBoys, Only the Paranoid Survive, Breaking Windows, but I’ve left those off the list even though they are very fun to read.

I’m sure I’ve missed some great ones! If you want suggest a replacement and/or share your own list, tweet me at @andrewchen.

How I first met Eric Ries and also why I’ve ordered his new Kickstarter-exclusive book The Leader’s Guide

Taken a few weeks ago at dinner, at Mission Rock in Dogpatch

tldr

It’s the last week to order Eric Ries’s new book, called The Leader’s Guide. In a very innovative experiment, it’s being published exclusively on Kickstarter. It’s the only way to buy a copy. I’ve already ordered a signed version and encourage you to support his work too. Here’s the link.

Making entrepreneurship mainstream

Like many of you, I’m a huge fan of Eric – he’s created a compelling, cohesive framework for thinking iteratively and entrepreneurially about products. The ideas are so powerful that the ideas in the book – such as “pivoting” and “MVP” – are now part of industry jargon and have even been featured on HBO’s Silicon Valley. (Also, isn’t it inevitable that he makes a cameo at some point?) The ideas in Lean Startup are amazingly powerful, and I continue to reference them all the time.

How I first met Eric

Last month in March 2015, I hosted a dinner at Mission Rock in Dogpatch where he was a special guest, and we talked about how we first met back in 2008. Eric and I had our first coffee before The Lean Startup was a real thing, when he was between jobs and hanging out at Kleiner Perkins. (PS. if you’re interested in attending events like this in the future, subscribe to my newsletter and you’ll get email updates if I do this again sometime)

Anyway, here’s how I first got to know Eric- at that point, I was writing a niche, mostly unread blog about tech and products, at the end of my stint as an Entrepreneur-in-Residence at Mohr Davidow Ventures. I had maybe 100 readers total. It was thrilling to find another niche, mostly unread blog full of content I was interested in :) Looking at my referer traffic, I noticed I was getting a tiny bit of traffic from a blog called “Startup Lessons Learned.”

I clicked through, and my mind was blown…

First off, the blog was anonymously written. There were a ton of essays across a bunch of meaty topics – picking products, continuous deployment, landing pages, and metrics. It was obviously from someone who was on the front lines. I couldn’t tell who was writing it, but whoever it was, the content was amazing. I bookmarked it and added it to my Google Reader, and would diligently check for updates every week.

I just couldn’t believe that someone was writing this much great stuff without taking credit for it :) Eventually I found a cryptic email address from the blog, decided to write in to figure out who the hell was writing this amazing content. Soon after, I got a quick reply, and that’s how we first met.

A few months later, Eric told me a few months later he was going to leave Kleiner to work on a book. I was very confused :) Turns out that book he was working on was The Lean Startup, and it ended up doing pretty well!

Fast forward

The success of The Lean Startup has changed the culture of entrepreneurship across the world. And many new ideas, frameworks, and refinements have been built on top of the ideas presented in the original book. There’s a ton of lessons learned from trying to implement these ideas across a wide variety of industries – for example, at the aforementioned dinner event we heard from Eric on how people have tried to apply the ideas to non-tech industries like manufacturing, aerospace, as well as some of the nuances of applying MVPs in a design-centric world of consumer mobile apps.

Because of this, I was thrilled to hear that a lot of these case studies and ideas have been collected into a new book, The Leader’s Guide. I ordered my copy immediately upon hearing about it.

Here’s the link if you want to check it out too:

The Leader’s Guide, by Eric Ries.

This is what free, ad-supported Uber rides might look like. Mockups, economics, and analysis.

Cheaper and cheaper rides

Free, ad-supported Uber rides are inevitable, and if Uber doesn’t do them, a different competitor – perhaps Google! – will do it. It would be the next step in the industry’s trajectory towards lowering prices. Uber started in the high-end of the market, as “everyone’s private driver” which emphasized quality, but the early pricing was out of range for most. Dropping prices will increase demand, grow the market, and nothing will do that faster than going free.

Starting with UberX and now UberPool, each tier of service has dropped the price, tapping into more and more latent demand. Today, the figures are staggering – in San Francisco, Uber’s revenue is 3X bigger than the city’s entire taxi industry. Worldwide, the company now does 1 million rides per day and is adding 50,000 new drivers per month. Not bad at all. I wrote a tweet about this concept a few weeks ago and wanted to expand more on this topic.

Free!

The next step is free. Lowering prices drive all sorts of goodness- more rides, busier drivers, shorter wait times – all which powers the company’s network effects. So how would you push the prices even lower than UberPool?

Well, here’s a crazy idea:

UberZero. A free, ad-supported tier of service that’s cheaper than UberPool and UberX.

That’s right, ads. I think it can be done well. And no, I don’t mean the cheesy in-taxi TVs that play ads nonstop, because those are broken for a variety of reasons I’ll cover. Instead, my proposal would be to put the ad units on your smartphone, in the dead time while waiting for your car and when you’re on your ride. And then to connect these ads with the big existing markets for app installs, lead generation, video ads, and local ads.

After all, advertisers are already comfortable paying a couple bucks for a variety of direct response actions from users. Individually, or together, you could imagine the above budgets making a big dent into the price of a single ride. In some cases, it might just be a discount of $1 or $2 off. In other cases, you might make the ride completely free.

Mockups for four potential ad units

Here’s four potential ad units that might work. These mockups were done in collaboration with the talented Chris Liu (@machinehuman), who’s done UX at Mercedes Benz, Alexa/A9, and IMVU. It was fun to throw together a couple designs.

Without further adieu, some of the concepts:

1) App Installs

The first and most obvious opportunity would be to tap into the ecosystem of paid app installs. Most of the $10B+ market for mobile ads is from driving app installs.

The user experience would be something like this- today, right after you book a ride, you often just sit there, staring at your phone, wondering how many minutes it takes for an Uber to travel a few blocks in San Francisco. Instead of just twiddling your thumbs waiting, how about getting a buck or two off your ride just from downloading and playing with an app?

Or similarly, imagine your current in-car experience. I often get into an Uber, pull out my phone, and do a little email during the ride. It would be easy to simply redirect my attention to an app, or a video ad, or some other activity that creates value for both myself and an advertiser.

It might look something like this:

As mentioned earlier, app developers are often paying $3-10 per install, especially in the games and commerce categories. This is a meaningful % when UberPool currently lets you go anywhere in San Francisco for $7 flat fee.

The biggest problem with this is that this is an incentivized install, which performs worse and Apple doesn’t like it. The plus side is that the folks who are really spending money in this area direct marketing-oriented and will back out the proper Cost-Per-Install to bid given all of that. As for Apple’s dislike of incentivized installs, you could certainly combine it with other ad units, and make the install a completely optional thing, which brings us to the next idea…

2) Video ads

One of the most compelling new ad formats for mobile is video, which are commanding high rates, especially when combined with a call to action to install an app. This is one of the many reasons why ad-supported companies like Twitter and Facebook are doubling down on in-stream videos.

So while you wait for your car to arrive, or once you get into the car, just watch a short clip that does a full-screen takeover of your phone. Then after you watch, the ad presents an optional action to download the app, which is a double dip on value. This packages both a brand ad with some a direct response ad unit, making for a powerful combination.

In Snapchat’s early tests on video advertising, Adweek and others have reported they are asking $750k, equivalent to a $100 CPM to participate. There’s no reason why Uber wouldn’t be able to command similar rates, especially for endemic advertisers in travel, shopping, and local.

It might look something like this:

The key problem here would be to provide context and targeting. A classic TV ad against a show like, say, Oprah, provides both context, targeting, and a brand halo effect. An ad to an anonymous passenger isn’t compelling until you know a little bit more about them.

This begs the question, what do we know about a passenger? What would make sense from a targeting standpoint? Targeting is interesting because it’s an anonymous segment of people, which you could make off a number of interesting values:

- Name

- Contact info (email/phone)

- Location

- Where they’re coming from and where they’re going

- Work or personal credit card

Of course from a targeting perspective, you’d never pass on the personally-identifiable information to an advertiser, unless there was opt-in (more on that later!). But how compelling would it be to for example target people in a segment like the following:

- Passengers heading to a movie theater

- Passengers coming from SFO airport, heading to SOMA

- Passengers with email addresses like @google.com and @fb.com

- Passengers traveling in a group of 2+ going out on a Friday night

- Passengers heading home from work, or vice versa

- Passengers heading to the Dreamforce conference

- … and many more combinations

Now ask yourself, who else is able to deliver targeting ad inventory like this? There’s a very short list of companies that could even contemplate it. Of course it’ll be up to Uber as well as passengers to decide whether or not this kind of targeting criteria can be aggregated anonymously for ad targeting, but history has shown that ad targeting options tend to increase rather than decrease over time.

If you found the examples above compelling, imagine an instant rebate on your ride that relied on opt-in from the passenger to share this contact information directly. There’s a whole world of leadgen that’s willing to pay big bucks for accurate contact information for people who are in the market for targeted services and products.

3) Lead gen, especially for SaaS/B2B

I find leadgen an especially intriguing possibility because it’s commonplace for advertisers to pay something like $10 for an email address. For a SaaS/B2B advertiser, that number is even higher, as much as $30-50 in some cases. And if you’re talking about getting a credit card alongside an app install, that might be as high as $200 or more.

Of course you could never pass along a passenger’s contact info + credit card number without their consent. But what if you made it frictionless to consent? Then that previous list of attributes could all be sent in a series of confirmations: Name, contact info, payment information, etc.

At the heart of this is the fact that segmentation/targeting makes some audiences much more valuable than another. Today, a service like Uber charges a C-level executive the same price as the Average Joe. Imagine if you could have a leadgen campaign where an advertiser decides that someone with a “name@google.com” address is pretty valuable given that they’re a Google employee. Or perhaps it’s interesting to know that they are coming from a Salesforce conference.

You might provide a call to action like this:

This would make obvious sense for the high stakes world of SaaS/B2B leadgen, but it might also make sense to target a wide consumer base, especially around commerce. For example, targeting travelers who are arriving from the airport, to target them with highly personalized hotel/tour offers. Or targeting hardcore movie or concert-goers for their next night out.

Similar to the video ad scenario, the targeting capabilities would be key. Targeting based on location and context is key. And as I think about this, the most compelling part of the whole thing is that Uber/Lyft have data and context that is unique in the industry. They know where you are going, and where you are coming from, and enable you to go from Point A to Point B.

You know who else is like this and has created the most profitable and targeted advertising ever? Google, of course.

Google’s superpower is the Power of Redirection. When you search for something, Google can understand that intent and gently redirect you to the right place. Sometimes this is a destination that they deem relevant based on their algorithms, but sometimes, they just take you somewhere that’s paying them a bunch of money. This superpower is very valuable.

4) The Power of Redirection for local ads

Uber also has the redirection superpower, albeit in a different flavor. Similar to Google, when you plot a destination, there’s intent built into that. All the examples I’ve used previously indicate this- heading to Facebook’s HQ means something. Leaving from SFO means something. Heading to the 49ers stadium on a Sunday means something. And it would be easy for Uber to take you to your destination, but maybe they can suggest somewhere else to go, or perhaps they can suggest a complimentary product/service.

And using the analogy of organic versus paid search, perhaps there are organic destinations and there’s also paid destinations. In the case where a ride can be redirected to a paid destination, then Uber can literally, actually drive foot traffic. Pretty amazing!

For a trivial example, you might imagine something like this, that redirects you to a nearby Starbucks as a detour on your ride:

(The second mockup that bundles in restaurant reservations was sent in by Marc Köhlbrugge, founder of BetaList – thanks!)

You could imagine a clear application for travelers of course. Heading to the W Hotel? Why don’t you try an Aloft hotel and get $X off your stay. Think about how compelling this is compared to other forms of getting local foot traffic. Billboards? Radio? Well, in this case you can literally get someone to your footstep.

I think this could be fundamentally a new market, although it would make sense to tie this back to the $4.5B mobile/local ad market. Or you could tie it back to the unit economics of something like pay-per-call, where local vendors are willing to buy a live phone call with a customer for $10. Nevertheless, still super compelling when you are talking about tens of billions of local ad dollars moving to mobile over the next decade.

Lots of practical challenges

But wait, could you really make all rides free all the time? Maybe not. After all, there’s aren’t infinite drivers. Won’t this make the ride UX horrible? Maybe, which is why you’d have to be thoughtful with the design. Another issue is that advertisers won’t pay for passengers to download the same apps over and over again – they’ll want frequency caps. And Apple doesn’t like incentivized installs, or maybe passing PII to advertisers will be frowned upon by the press. All very real issues that will have to be worked out over time.

And in the end, maybe it’ll turn into free* with an asterisk, limited to 1 per day within your city and only in the morning. Or just another way to decrease fares by another 25%. Whichever way it’s done, I’m convinced it will be done, because the benefits are too great.

Isn’t this perfect for Google?

If Uber doesn’t do this, perhaps Google will. There’s been rumors that they’re working on some kind of Uber-competitor, and they already have all the advertisers to make the above ad units work.

Providing free, ad-supported rides would certainly be a unique way to enter the market. Even more so, there’s network effects. Ad networks are fundamentally marketplaces, and they have tremendous network effects at scale. You could see the following virtuous cycle:

- Free rides = way, way more rides

- More rides = more advertising reach

- More reach = more interesting targeting options, and drivers

- More advertisers = more profitable yet free rides

- Which leads to more drivers, customers, and more

At scale, a network like this would be very hard to attack, especially when combined with existing ad businesses like the type that Google possesses. Thus, if we see Google launch an Uber-competitor, I think it’d be a matter of time before they experimented with this.

Why old in-taxi advertising systems suck

The final point I want to make is to contrast all of these ideas with the old in-taxi ad systems we used to see. If you need your memory jogged, they used to look something like this:

These systems suck. And they can’t generate the kind of economics to power the subsidy we’d want to see to make a dent on the actually fare price. The point isn’t to actually make money via advertising- the point is to drive down the cost of a ride so that the market is more efficient and liquid, creating network effects.

These old advertising displays are archaic:

- Passive advertising content

- Doesn’t know anything about you or your trip

- Can’t get you to download an app

- Limited internet connectivity

These systems are ineffective because ultimately, this display belongs to the taxi and not you. As a result, it lacks some of the key ingredients that an advertiser finds valuable: an easy way to get your contact info, or to get you to install an app on your phone. It’s good for display untargeted video ads and not much else.

That’s why Uber sits on a special opportunity to build an ad platform that’s never existed before. It’d be an ad platform that has unique access to context, intent, and built on your personal device. If it’s done well, advertisers will love it and consumers will be grateful to have free/discounted rides.

Yet another reason to be bullish about the company, in addition to all the great momentum they already have.

(Special thanks to Chris Liu collaborating on these great mockups that really make the discussion in this essay pop!)

Personal update: I’ve moved to Oakland! Here’s why.

My new neighborhood, in Jack London Square, Oakland, CA.

Where’d you move?

I moved to a tiny neighborhood called Jack London Square in Oakland. Yes, it’s named for that guy that wrote about the gold rush. I’ve only been here 3 months but I really like it so far. Previously, I lived in Palo Alto for 5 years, then about 2 years in the Lower Pac Heights neighborhood of San Francisco, but had never really spent much time in the East Bay. I had sort of heard that people were moving from SF to Oakland, but didn’t really have a reason to check out the neighborhood until a few people I know moved here.

Here were some of the articles I read while doing research:

- Oakland: Brooklyn by the Bay (New York Times)

- In Oakland, a Sign of Some Very High Times (TechCrunch)

- Why are all of my friends moving to Oakland? (Bold Italic)

- A beginners guide to Oakland (Bold Italic)

PS. if you call Oakland “the next Brooklyn” to people who’ve lived here for a long time, they don’t like it :)

I live near there too! / How do I find out more about it?

If there’s interest, I’ll host a tech get-together or two.

Sign up here to get updates on an upcoming brunch/drinks/dimsum/whatever in Oakland.

There aren’t too many tech people here, so it’d be fun to get the small community that is out here together.

Where is it relative to San Francisco? How’s the commute?

I travel to the city pretty much every day. I usually take the BART, and sometimes the ferry (it has wifi!).

There’s a couple ways to get to the city:

- BART (10min walk + 20min BART)

- Ferry ride (25min ride + walk from Ferry building)

- Car (30min without traffic, 60min+ with traffic)

I used to live in the Mission, and going from 24th+Mission to SOMA is about comparable to my current commute. However, I occasionally do have the morbid fear that there’ll be an earthquake while I’m underwater in the train.

Where’s all the good food?

Right now, the Uptown neighborhood is opening the most new/amazing restaurants, where you can eat before you go to the Fox Theater or the Paramount for a show. Jack London Square has great food as well – there’s an eclectic mix of fancy pizza shops, vegan, and southern. A quick walk into Chinatown provides an endless supply of cheap eats, and the Oakland Chinatown is huge – about 2x the size of the city’s, without the tourist stuff.

A quick map search shows you where all the food is- pretty much in the Broadway/Telegraph corridor, but Rockridge, Temescal, and Grand Lake do well too.

Doesn’t Oakland have a ton of crime?

Crime was one of my top concerns moving to Oakland, but if the spectrum in San Francisco is aggressive/disturbed people in the Tenderloin to the nicest part of Presidio Heights, I think Oakland is about the same. You wouldn’t want to walk around Market St at 3am and you wouldn’t want to do that on Broadway in Oakland either. (Palo Alto / Menlo Park / Atherton are on a whole other planet, of course)

The biggest lesson I’ve learned from exploring the long list of East Bay neighborhoods is that Oakland is very diverse, and while the crime factor is a big one, it’s an acute problem for some neighborhoods and less of a problem for others. So, it all depends (just like SF, btw).

Houses in the Oakland Hills look like the kind of fancy houses you’d see while driving on 280 in the peninsula. Some neighborhoods like Rockridge, Grand Lake, and Adams Point are small and upscale, not unlike University Ave in Palo Alto. Uptown/Downtown feels like Market Street in San Francisco, but inexplicably cleaner. My new neighborhood, Jack London Square, feels a bit like South Beach in SOMA.

On the other hand, neighborhoods in deep East Oakland don’t feel very safe. That’s where you can find the car sideshows on YouTube.

Is it cheaper to live there?

For now, buying or renting seems to be about 50-75% the cost of San Francisco. Maybe as low as 30% if you are adventurous.

Is Oakland really warmer than San Francisco?

Yep. Sort of like the peninsula, up to 10 degrees warmer. Sometimes I miss the fog.

Here’s a typical day on the waterfront in Jack London Square.

Where do you go for coffee?

The headquarters for Blue Bottle Coffee is here. Yes, there’s usually a line.

But there’s also a bunch of other coffee places too:

- Bicycle Coffee (free on fridays!)

- Peerless Coffee

- Mr. Espresso

Interestingly enough, the density of tech in Oakland is still relatively low. Cafes aren’t full of tech bros with terminal open. Coworking spaces are more likely to be nonprofits, writers, and sales, rather than unpronounceable names of startups. I’m sure a bit of this might change over time, and there’s been rumors of one of the big cos taking over the old Sears building in downtown.

How do I dress when I visit Oakland?

Like this video.

What’s the best way to visit Oakland?

The first step is to come out here by car/BART/ferry and check it out. I’d encourage you to do it, I think you’ll be surprised by how nice it is. And as I said above, if you’re interested in attending a casual get-together in the new neighborhood, or if you already live around here, just sign up on this mailing list and I’ll post some future updates.

The most common mistake when forecasting growth for new products (and how to fix it)

Forecasting weather is hard, and so is forecasting product growth.

Startups are about growth

Paul Graham’s essay in 2012 called “Startup = Growth” makes a big point in the first paragraph:

A startup is a company designed to grow fast. Being newly founded does not in itself make a company a startup. Nor is it necessary for a startup to work on technology, or take venture funding, or have some sort of “exit.” The only essential thing is growth. Everything else we associate with startups follows from growth.

The other important reason for new products to focus on growth is simple: You’re starting from zero. Without growth, you have nothing, and the status quo is death. Combine that with the fact that investors just want to see traction, and it’s even more important to get to interesting numbers. In fact, later in the essay, pg talks about how important it is to hit “5-7% per week.”

Getting to this number while trying to show a hockey stick leads to a bad forecast. Here’s why.

The bad forecast

The most common mistake I see in product growth forecasts looks something like this:

In this example, the number of active users is a lagging indicator, and if you multiply this lagging indicator of a growth curve, it’s a truism that the growth will go up and to the right. If you do that, the whole thing is just a vanity exercise for how traction magically appears out of nowhere.

And of course these growth curves look the same: They all look like smooth, unadulterated hockey sticks. The problem is, it’s never that easy or smooth. In reality, you’re upgrading from one channel to another, and in the early days, you do PR but eventually that doesn’t scale. Then you’ll switch to a different channel, which takes some time but also eventually caps out. Eventually you’ll have to pick one of the very few growth models that scale to a massive level.

The point is, incrementing each month with a fixed percentage hides the details of the machinery required to generate the growth in the first place. This disconnects the actions required to be successful with the output of those actions. It disassociates the inputs from the outputs.

In other words, this type of forecast just isn’t very useful. Worse, it lulls you into a false sense of security, since “assume success” becomes the foundation of the whole model, when entrepreneurs should assume the opposite.

Create a better forecast by focusing on inputs, not outputs.

How to fix this forecast

A more complete model would start with a different foundation.

It would:

- Focus on leading indicators that are specific to your product/business – not cookie cutter metrics like MAU, total registered, etc.

- Start with inputs not lagging vanity metrics

- It’d show a series of steps that show how these inputs result in outputs

- And, how the inputs to the model would need to scale, in order to scale the output

In other words, rather than assuming a growth rate, the focus should be deriving the growth rate.

If you plan to 2X your revenue for your SaaS product, which is done by doubling the # of leads in your sales pipeline, and those leads come from content marketing – well, then I want to know how you’ll scale your content marketing. And how much content needs to be published, and whether that means new people have to be hired.

That also means that if you want to 2X your installs/day, and plan to do it with invites, I want to understand the plan to double your invites or their conversion rates.

Or better yet, say all of this in reverse, starting with the inputs and then resulting in the outputs.

Inputs are what you actually control

Focus on the inputs because that’s what you can actually control. The outputs are just what happens when everything happens according to plan.

One helpful part of this analysis is that it helps identify key bottlenecks. If your plan to generate 2x in revenue requires you to 5X sales team headcount when it’s been hard to find even one or two good people, you know it’s not realistic. If your SEO-driven leadgen model assumes that Google is going to index your fresh content faster and with higher rank than it’s ever done, then that’s a red flag.

In the end, it’s also true what they say:

No plan survives contact with the enemy.

— smart prussian army guy

Keep that in mind while you fiddle around with Excel formulas, and you’ll be in good shape.

The race for Apple Watch’s killer app

The upcoming race

As the release of the Apple Watch draws near, we’re seeing press coverage hit a frenzied pace – covering both the product, the watch’s designers, sales forecasts, and the retail displays. That’ll be fun for us as consumers. But for those of us who are in the business of building new products, the bigger news is that we have a big new platform for play with!

The launch of the Apple Watch will create an opportunity to build the first “watch-first” killer app, and if successful, it could create a new generation of apps and startups.

Why new platforms matter – the Law of Shitty Clickthroughs

Regular readers will know that I’m endlessly fascinated by new platforms. The reason is because of The Law of Shitty Clickthroughs, which claims that the aggregate performance of any channel will always go down over time, driven by competition, spam, and customer fatigue.

When you have a big new platform, you avoid all of this. So it’s not surprising that every new platform often leads to a batch of multi-billion dollar companies being minted. With mobile, it was Uber, Whatsapp, Snapchat, etc. With the Facebook platform, we saw the rise of social gaming companies like Zynga. With the web, we had the dot com bubble. It’s very possible that wearables, led by the Apple Watch, could be that big too.

With the Apple Watch, we have fresh snow:

- Right after the launch, there’s a period of experimentation and novelty, where people are excited to try out new apps, no matter how trivial

- A barrage of excitement from the tech and mainstream press, which will publicize all the big apps adding integration

- A device built around interacting with notifications and “glances” which, along with the novelty effects, will cause engagement rates to be ridiculously high

- The app store which will promote apps that integrate with the Watch in clever ways

- Unique APIs and scenarios in health, payments, news, etc., leading to creative new apps in these categories

At the same time, there will be less competition:

- Many apps will take a “wait and see” approach to the platform

- Some teams won’t try at all Apple Watch, since it won’t be easy to jam their app’s value into a wearables format – for example, you can’t just cram any game on there

- The best practices around onboarding, growth, engagement still have to be discovered – so there’s a higher chance someone new will figure it out

The above dynamics mean that the Watch launch will lead to some exciting results. Apple has been thoughtful and extraordinarily picky about bringing out new products, so with the Watch, we know they’ll put real effort and marketing prowess behind it. Combine that with the rumored ramp up to millions of units per month, and you can imagine a critical mass of high-value users forming quickly.

What kinds of apps will succeed? It’s hard to answer this question without looking at what you can do with the platform.

The Human Interface Guidelines is worth a skim

Beyond the ubiquitous buzz stories that have been released, it’s hard to have a nuanced discussion about the Apple Watch until you really dig into the details. Here to save us are two documents:

Both documents offer some tantalizing clues for the main uses for the Watch, as well as the APIs offered by Apple for developers to take advantage of. The HIG document is particularly enlightening. Going through the screenshots, here are the apps that are shown via screenshot:

- Visual messaging

- Weather

- Stock ticker

- Step counter

- Calendar

- Photo gallery

- Maps

- Time, of course :)

For the most part, this is exactly what you’d expect. These are all apps that have existed on the phone, and the Watch serves as an extra screen. I’m sure this will only be the start.

The more interesting question is what the new Watch APIs will uniquely allow.

Apple Watch will supercharge notifications

One of the biggest takeaways in reading through the HIG is the prominence of the notifications UI. Although you might find yourself idly swiping through the Glances UI to see what’s going on, it seems most likely that one of the most common interactions is to get a notification, check it on your watch, and then take action from there. This will be the core of many engagement loops.

For that reason, Apple has designed two flavors of notifications – a “short look” that is a summary of the new notification, and a “long look” that’s actually interactive with up to 4 action buttons. Here’s a long look notification:

Because it’s so easy to check your watch for notifications, and you’ll have your watch out all the time, I think we’ll see Apple Watch notifications perform much better than push notifications ever have. Combine this with the novelty period around the launch, and I think we’ll see reports of much higher retention, engagement, and usage for apps that have integrated Watch, and these case studies will drive more developers to adopt.

Waiting for the Watch-first killer app

Succeeding as a Watch-first app remains a compelling thought experiment. We saw that after a few years of smartphones, the question “Why does this app uniquely work for mobile?” is an important question.

Apps that were basically ports of a pre-existing website ended up duds – crammed with features and presenting a worse experience than just using the website. Contrast that to the breakthrough mobile apps that take advantage of the built-in camera, always-on internet, location, or other APIs available. Said another way, many flavors of “Uber for X” have failed because it’s unique to calling a taxi to constantly need to consume the service in new/unknown locations, and with high enough frequency for this consumption. Not every web app should be a mobile app. In the same analogy, the majority of apps in the initial release of the Watch may take it to simply be a fancier way to show annoying push notifications, and drive usage of the pre-existing iPhone app.

The more tantalizing question is what apps will cause high engagement on the Watch by itself, with minimal iPhone app interaction? That’s what a Watch-first killer app will will look like. I’m waiting with a lot of excitement for the industry to figure this out.

Good luck!

For everyone working on Watch-integrated apps, good luck, and I salute you for working to avoid the Law of Shitty Clickthroughs. If you’re working on something cool and want to show me, don’t hesitate to reach out at @andrewchen.

My top essays in 2014 about mobile, growth, and tech

Hello readers,

Happy 2015 and hope everyone had a relaxing holiday. As always, more essays are coming soon for the next year. In the meantime, I wanted to share some of my essays published here over the last year. If you want to stay up to date, just make sure to subscribe for updates.

Also, thanks to the SumoMe team (specifically Noah Kagan!) for supporting my hosting costs. I’ve used SumoMe since the product was in alpha and find it immensely helpful in building an audience.

Thanks,

Andrew

The essays

Without further ado, here’s a selection of essays published in 2014:

Make content creation easy: Short-form, ephemeral, mobile, and now, anonymous

How to design successful social products with 3 habit-forming feedback loops

How to solve the cold-start problem for social products

Why consumer product metrics are all terrible

There’s only a few ways to scale user growth, and here’s the list

Why aren’t App Constellations working?

New data shows up to 60% of users opt-out of push notifications

Early Traction: How to go from zero to 150,000 email subscribers

New data on push notifications show up to 40% CTRs, the best perform 4X better than the worst

Mobile retention benchmarks for 2014 vs 2013 show a 50% drop in D1 retention

Why messaging apps are so addictive

If you want more, here’s the link to subscribe to future updates: http://eepurl.com/xY3WD.

Why messaging apps are so addictive (Guest Post)

[Andrew: This guest post is written by my friend and former Palo Alto running partner, Nir Eyal. Messaging apps have been a fascinating area within mobile, and the big reason for it is that the metrics – especially engagement – have been amazingly strong. I asked Nir to write a bit about why this might be the case, using the habit model. He’s in a unique position to comment on this: After spending time at Stanford and in the startup world, recently he’s been writing about psychology – particularly habit-building – and applying that to the realm of technology and products. Check out his new book Hooked: How to Build Habit-Forming Products and Nir blogs about the psychology of products at NirAndFar.com.]

Nir Eyal, Author of Hooked:

Today, there’s an app for just about everything. With all the amazing things our smartphones can do, there is one thing that hasn’t changed since the phone was first developed. No matter how advanced phones become, they are still communication devices — they connect people together.

Though I can’t remember the last time I actually talked to another person live on the phone, I text, email, Tweet, Skype and video message throughout my day. The “job-to-be-done” hasn’t changed — the phone still helps us communicate with people we care about — rather, the interface has evolved to provide options for sending the right message in the right format at the right time.

Clearly, we’re a social species and these tech solutions help us re-create the tribal connection we seek. However, there are other more hidden reasons why messaging services keep us checking, pecking, and duckface posing.

The Hook

In my book, Hooked: How to Build Habit-Forming Products, I detail a pattern found in products we can’t seem to put down. Though the pattern is found in all sorts of products, successful messaging services are particularly good at deploying the four steps I call, “the Hook,” to keep users coming back.

The Hook is composed of a trigger, action, variable reward, and investment. By understanding these four basic steps, businesses can build better products and services, and consumers can understand the hidden psychology behind our daily technology habits.

Nir Eyal’s Hook Model

Trigger

A trigger is what cues a habit. Whether in the form of an external trigger that tells users what to do next (such as a “click here” button) or an internal trigger (such as an emotion or routine), a trigger must be present for a habitual behavior to occur.

Over time, users form associations with internal triggers so that no external prompting is needed — they come back on their own out of habit. For example, when we’re lonely, we check Facebook. When we fear losing a moment, we capture it with Instagram. These situations and emotions don’t provide any explicit information for what solution solves our needs, rather we eventually form strong connections with products that scratch our emotional itch.

By passing through the four steps of the Hook, users form associations with internal triggers. However, before the habit is formed, companies use external prompts to get users to act. For messaging services, the external trigger is clear. Whenever a friend sends a message via WhatsApp, for example, you see a notification telling you to open the app to check the message.

WhatsApp’s External Trigger

Action

Notifications prompt users to act, in this case tapping the app. The action phase of the Hook is defined as the simplest behavior done in anticipation of a reward. Simply clicking on the app icon opens the messaging app and the message is read.

When the habit forms, users will take this simple action spontaneously to alleviate a feeling, such as the pang of boredom or missing someone special. Opening the app gives the user what they came for — a bit of relief obtained in the easiest way possible.

Variable Reward

The next step of the Hook is the variable rewards phase. This is when users get what they came for and yet are left wanting more.

This phase of the Hook utilizes the classic work of BF Skinner who published his research on intermittent reinforcement. Skinner found that when rewards were given variably, the action preceding the reward occurred more frequently. When forming a new habit, products that incorporate a bit of mystery have an easier time getting us hooked.

For example, Snapchat, the massively popular messaging app that 77% of American college students say they use every day, incorporates all sorts of variable rewards that spike curiosity and interest. The ease of sending selfies that the sender believes will self-destruct makes sending more, shall we say, “interesting,” pics possible. The payoff of opening the app is seeing what’s been sent. As is the case with many successful communication services, the variability is in the message itself — novelty keeps us tapping.

You never know what you’ll see when you open Snapchat

Investment

The final phase of the Hook prompts the user to put something into the service to increase the likelihood of using the service in the future. For example, when users add friends, set preferences, or create content they want to save, they are storing value in the platform. Storing value in a service increases its worth the more users engage with it, making it better with use.